Long time before Budget,it is Killing time!PM hints at increased private sector role in Railways! Get bullet to destroy your rural India!

If private players are allowed to harvest in the most sensitive defence arena,why should the private players not to be allowed to play on Railway pitch!In fact,they have already captured most of the structural Railway services skipping Railway staff and the workforce in Railway is getting size zero with greater speed than the Bullet train.

Palash Biswas

The HinduA securityman stands guard at the Katra Railway Station in this July 3, 2014 photo. Prime Minister Narendra Modi flagged off the inaugural Katra-Udhampur train at Katra on Friday. Photo: Nissar Ahmad

Long time before Budget,it is Killing time!

No wonder that ahead of the rail budget, Prime Minister Narendra Modi on Friday hinted at an increased role of the private sector in development of railways.Cent percent FDI is allowed in defence.If private players are allowed to harvest in the most sensitive defence arena,why should the private players not to be allowed to play on Railway pitch!In fact,they have already captured most of the structural Railway services skipping Railway staff and the workforce in Railway is getting size zero with greater speed than the Bullet train.

Here you are!The Modi government has started the turnaround train already - having recently implemented the price hikes introduced in the interim budget in order to maintain the fiscal health of the railway and now the PM is toying with the idea of privatization of railway ...Prime Minister Narendra Modi on Friday called for railways to have better facilities than airports and asked "private parties" to be ready to invest.

The new government will next week roll out plans to overhaul its sprawling rail network, dubbed the "lifeline of India",

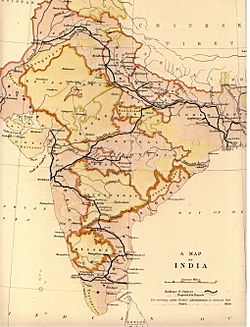

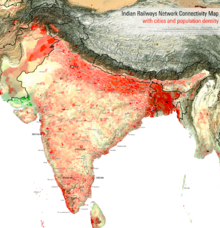

One of the world's largest rail networks (11,500 km long) Indian Railways is probably the biggest transporter of people.

The impact: Railway-related stocks are in focus today and are trading higher by up to 6% ahead of the Railway Budget on Tuesday, July 8. Texmaco Rail & Engineering, Titagarh Wagons, Kalindee Rail Nirman (Engineers), Kernex Microsystems (India) and Stone India are up between 5-6% on the Bombay Stock Exchange (BSE). In comparison, the benchmark Sensex was up 0.20% at 25,875.

Last month, Nirmala Sitharaman, minister for commerce and industry had said that the country needs foreign direct investment (FDI) for expansion of railway network. Railways require large-scale resources for modernisation and improving systems and processes for higher safety.

Among the individual stocks, Texmaco Rail and Engineers has rallied 6% to Rs 127 on BSE. Titagarh Wagons, Kalindee Rail Nirman (Engineers), Kernex Microsystems (India) and Stone India are up 5% each.

Patriotism is the theme while Indian leaders visit Kashmir.No one thiks beyond lest he should be branded as the enemy of the nation. That is why by putting Katra on the railway map of India, Modi has begun his journey to improvise the railways connectivity in the country. In his bid to make Indian Railwyas world class Modi had earlier said that the private parties will play a major role in doing so.

No doubt, it is the most opportune time to declare selling off Railway.

just see the disinvestment council report of NDA First.

http://indiaimage.nic.in/pmcouncils/reports/disinvest/disinvest.html

The road map is followed step by step.The council was headed by private plyers like

Shri GP Goenka

Shri Rajeev Chandrasekhar

Shri Nusli Wadia

We have been talking to workers from every sector since the report was public.For FDI and strategic sell of,for divestment sectors like defence, mining, banking, aviation, infrastructure, steel, retail, communication, energy,media,services,health,insurance,ports and railway always have been on top priority.I have written hundreds of stories on these themes in English,Bengali and Hindi.I have been visiting Mumbai regularly for seven years and loitering countrywide.But trade union dominated Indian workers were never convinced.The could never smell the imminent mass destruction.

Now it is hindutva with development flavour.Most of Rural India has to be just killed to enhance promoter builder corporate fascist zionist baniya raj.

Industrial corridors do away with agrarian India and Indians.Mega Sez and Mega cities would determine the horizon.

Just take the Yamuna Express Way which has to get three meg cities in near future wiping out the Western UP Ganga Yamuna fields and the green,which would displace and marginalise the agrarian population.This region is torn in communal strife and represented by riot experts.

Those people who may not afford reservation in the sleeper class,dream to travel by Bullet trains these days.Wah.

Meanwhile,the Oil Reliance Ministry is likely to move the Cabinet Committee on Political Affairs (CCPA) soon with an expert panel recommendations of raising kerosene price by Rs 4 a litre and cooking gas (LPG) rates by Rs 250 per cylinder.

Look!Kirti Parikh himself says there is no proposal to hike prices, but the number of subsidised cylinders may be reduced. He believes a cap at six cylinders is reasonable and it will also encourage people to use gas efficiently.Never mind,it is carnival.

Wait!Industry body Assocham has sought tax incentives, market-linked tariff rates and grant of infrastructure status to the port industry in the upcoming budget for turning India's coastline into a growth catalyst.

And the finance Minister is suggesting that there is no cause of panic as inflation and price rise touch the limits of the sky.However,blaming hoarders for the rise in food inflation, finance minister Arun Jaitley on Friday said there is "no panic situation" and asked the states to take measures to crackdown on hoarding and black marketing to rein in prices.

Referring to onion and potato prices, finance minister Jaitley said 'there has been a record output and there is no shortage of these items'.

Promoters of Black Money alias FDI make promises to get the Black Money out of Swiss Bank accounts.Mind you,Bangladesh prime minister Haseena Wajed is also playing the same gimmick to keep Khaleda Zia, greatest BJP friendly zehadi leader of south Asia at bay.

"We want the railway stations to have better facilities than airports. This is our dream and it is not a difficult thing to do and this is economically viable too. I have discussed it in detail with my Railway friends. You will see a change in near future. In that, private parties would also be ready to invest because this is a good project economically and will benefit everyone. This would be a win-win situation project and we want to move ahead in this direction in the coming days," he said.

The Prime Minister was addressing a gathering at the inauguration of the Katra rail line project in Jammu.

Mr. Modi said the railway stations in metros and important cities such as Jammu would be priority for the government with regard to development of railway stations.

He said the Railway Ministry has been given a detailed outline of the project. Railways Minister Sadananda Gowda will present his maiden Rail Budget on July 8 in Parliament. The Government has already hiked the fares for passenger travel and freight transportation.

Reuters reports:

The Reserve Bank of India (RBI) will issue the guidelines that will be used to grant on-tap and differentiated banking licences later this year.

On the sidelines of an event on Friday, RBI Deputy Governor R. Gandhi also said the assessment of the monsoon rains on the economy would not be carried out until later.

The monsoon strengthened at the start of the key planting month after recording the weakest first month of the June-September rainy season in five years, weather officials said on Thursday.

I am afraid that the trade unions are going to do nothing to stop the destruction of Public sector banks as suggested by disinvestment plan.

Mind you,Industry body Assocham has sought tax incentives, market-linked tariff rates and grant of infrastructure status to the port industry in the upcoming budget for turning India's coastline into a growth catalyst.

It has to be noted that the industry chamber batted for reduction in customs duty on import of equipment for port projects; exempting port projects from Minimum Alternate Tax (MAT) and granting infrastructure status to the port industry.

A Public-Private Partnership (PPP) based-policy to encourage port development and management needs to be carved via BOOT (Build Own Operate Transfer) structures, it said.

Besides, it said that to generate ample private sector interest, there is a need to introduce market-linked tariff rates, noting that port development is bound to act as a propeller for export oriented industries.

Coastal special economic regions (SEZs) /investment regions/ clusters along the lines of Chinese model of coastal development must be incentivized, it said, adding that keeping in mind high income and employment multipliers of the sector, a specialised policy for port-tourism can be carved out.

The industry chamber further advocated establishing India as a Tidal Energy hub to reduce dependence on coal and to meet future energy requirements. Besides, firms related to other sectors including private security and small and medium enterprises (SMEs) have also put forth their suggestions for the upcoming budget.

"The government should strive to create a favourable environment for SMEs ... There is a need for reduction in the lending rates as SMEs continue to pay interest at 19-20 percent for bank loans. Delayed payments have been an area of concern for SMEs that contribute to reduced working capital for SMEs," Power2SME CEO R Narayan said.

While observing that the private security industry is a sunrise sector, security company G4S India has proposed measures like increase in FDI limit, simplified taxation policy and categorisation of private security guards as skilled and highly skilled workers under the Minimum Wage Act. The government reduced foreign direct investment (FDI) limit from the earlier 100 percent to current 49 percent by introducing Private Security Agencies Regulation Act (PSAR), it said.

| How to get Disinvestment Going Building India's Future Report of the Special Subject Group Members : Shri GP Goenka Shri Rajeev Chandrasekhar Shri Nusli Wadia

How to Get Disinvestment Going "Building India's Future"

1. Why disinvest? Since reforms began in 1991, this is the first time after 1993-94 that one feels that reforms are going to go forward. Except industrial delicensing and some changes in the financial sector, almost nothing has so far happened on domestic economic reforms. The second generation of reforms is about domestic economic reforms. And domestic economic reforms have to begin with public sector reform and privatization. Without this as a prerequisite, nothing else is possible. Nothing else can happen. Modern Foods is a good beginning. This report will express some skepticism about what is proposed for Indian Airlines. But more than these two, what has been reported in the media about the government's intentions is the really positive signal. Why is disinvestment necessary? THE CITIZENS' CHARTERv Who are shareholders of public sector undertakings (PSUs)? Indian citizens are, the government only acts on their behalf. v As percentage of GDP (gross domestic product), does the government need to spend so much? The government in India spends 32.6% of GDP. Indonesia spends 16.2%, South Korea 17.8%, Malaysia 23.2% and Thailand 18.6%. v Only 3.5% of GDP is spent on education. v If government expenditure is reformed, 5.1% of GDP can be saved – 1.5% from privatization and repurchase of public debt, 0.6% from fertilizer subsidies, 0.2% from PDS, 0.3% on public administration and 2.5% from smaller transfers to States. This is an additional expenditure that can be made on primary education and rural health care. v The government subsidizes losses of almost Rs 80 billion per year made by around 120 Central PSUs. v Each individual citizen pays Rs 80 a year, each household pays Rs 400 a year. Are 6 million jobs in PSUs worth it? v The government has no right to decide, shareholders must decide.

1 Coal India employs 700,000 people, of whom, one-third are redundant. In the entire governm ent, 2 million people are believed to be redundant. This is out of a total employment of 20 million, of which, 6 million is in PSUs, 3 million in the Central government, 7 million in State governments and 2 million in local bodies. 2 The cash value of most PSUs is more than the present value of profit flows, even if the cash value is evaluated on book value of assets. The conclusion is stronger if valuation is done at current value. Perhaps it is necessary to mention that some loss-making PSUs also have positive market value. 3 Roughly half of these make losses. Of the ones that make losses, roughly half have eroded their net worth and these figures are only for the Centre. BUILDING INDIA'S FUTURE SECOND GENERATION REFORMS PSUs have never earned profits that have exceeded 6 per cent of capital employed (Table 1)4. Their return on capital has been between 5 and 7 percentage points below the rate of interest on long term government bonds. That is just one measure of the lost opportunity cost of return. Table 1: Profitability of Indian PSUs

These poor returns have occurred despite huge rents that accrue from government monopolies like petroleum and power. Once these are netted out, PSUs show negative return (Table 2)5.

4 Public Enterprises Survey. PAT = Profits after tax; GS = Gross sales; CE = Capital employed. 5 L. Bhandari and O. Goswami, The Wasted Years: The Public Sector in India, National Council of Applied Economic Research, forthcoming, 2000.

Table 2: Differential PSU profitability (%)

For a while, governments tried the system of having target-setting memoranda of understanding (MOUs) between PSUs and their administrative ministry. The idea was to make a PSU achieve greater efficiency without diluting the government's majority ownership and control. Despite the Department of Public Enterprises showing high 'success' rates, the MOUs failed.6 First, there is a sample selection bias: virtually no loss-making PSU signs a MoU. Thus, over 55% of the PSUs remain outside the MOU ambit. Second, the targets are set low enough to ensure achievement. The post-MOU performance of the so-called 'excellent' and 'very good' achievers is no better — and often worse — than before. 6 Bhandari and Goswami (2000). 2. Tactics and strategy There is a difference between tactics and a strategy. So far, disinvestment has been driven by the tactical compulsion of financing the fiscal deficit. This is perhaps the reason why the word privatization has not been used until recently, the word disinvestment tending to imply a soft choice. This is in contrast to a country like Britain, where privatization and disinvestment were driven by a conscious recognition that this improves efficiency.7 However, there are no soft choices. As countries like Peru, Brazil, Chile, France, Morocco, Poland, Indonesia, Malaysia, the former German Democratic Republic, the Philippines, Pakistan, Sri Lanka, Taiwan, Indonesia and New Zealand have recognized, the fiscal deficit or releasing resources for social or infrastructure sectors cannot be the only reasons for disinvestment. Other reasons are improved efficiency and competition and broadening and deepening the capital market. PSU reform attempts go back to the 1980s, where there was some attempt to increase functional autonomy of PSUs, without privatization and disinvestment. Post-1991, there were ad hoc equity sales in around 50 PSUs, with equity sales ranging from 5% to 49%. There was a hang-up about letting go of more than 51% equity.8 This led to some improvement in efficiency and pre-tax profit as a percent of capital employed in PSUs more than doubled from the base figure of 3.4% in 1990-91.9 This illustrates what is possible with full-fledged reforms. 7 However, the Rangarajan Committee Report (Report of the Committee on Restructuring Public Enterprises), 1992, did mention improved efficiency as an objective. 8 As a parallel move, fresh issues of equity in global markets for expansion also diluted government equity. 9 See detailed figures in M.S. Ahluwalia, "India's Economic Reforms: An Appraisal" in Jeffrey D. Sachs, Ashutosh Varshney and Nirupam Bajpai edited, India in the Era of Economic Reforms, Oxford University Press, 1999.

SECURING THE FUTURE OF INDIA'S PSUs

The hang-up about giving up more than 51% equity was possibly given up with the setting up of the Disinvestment Commission in 1996, a commission that has now been wound up. The Disinvestment Commission examined 50 PSUs, ostensibly non-strategic and non-core, where government equity could be brought down to zero and management handed over. In most cases, it is now accepted that government equity can be brought down to 26%. The 51% figure is important. Any firm where the government has more than 50% equity is legally interpreted as part of Article 12 of the Constitution and is accountable to administrative ministries, government audits and Parliament. There will also be the Central Vigilance Commission (CVC) and the Central Bureau of Investigation (CBI). Moreover, with a 51% hang-up, new private shareholders will always be a minority on the boards. Naturally, bids would have been higher had the government agreed to dilute equity to 26% in a time-bound fashion. However, driven by tactical considerations, the entire disinvestment process so far has been left to bureaucrats who do not necessarily have a perfect understanding of how capital markets operate or how international investor decisions are taken. Therefore, issuance is piecemeal, there are long delays in appointment of lead managers and finalization of IPOs (initial public offerings) and flawed criterion used in selection of lead managers. There has been lack of transparency, a fact that reports of the Comptroller and Auditor General (CAG) of India have also commented on. It should not be surprising that foreign investments in the disinvestment process in India are a trickle compared to global investments that flow into disinvestment processes world-wide. It is remarkable that not a single PSU is yet under autonomous private management and the cross-holdings by oil companies is a particularly perverse illustration of this phenomenon. It is only recently that the government has become a bit more serious about disinvestment. As the following will make clear, this report favours what has been done for Modern Foods, but not what has been done for Indian Airlines, unless that is a temporary step. Unlike what happened historically, a strategy will have a proper vision and plan of action.

First, the management and responsibility of the entire disinvestment process should exclusively be with the Disinvestment Ministry (DM). Setting up such a DM ensures transparency and fairness and also contributes to a comprehensive approach to disinvestment, as opposed to ad hoc decisions. This is one reason why most developing countries have opted for formal structures. Other ministries can be co-opted only if it is absolutely necessary. The Secretary of DM must have sufficient capital market experience. For each proposal, the DM will be responsible for taking the proposal to a Cabinet Committee on Disinvestment that will consist of the Prime Minister, the Finance Minister, the Disinvestment Minister and any other economic ministry that may be necessary from the point of view of the specific proposal. The DM will be a specific pre-determined target of capital that will be raised over a fixed time horizon, say the next two years. Thus, for the next two years, the DM will develop a plan and course of action that addresses individual companies and sectors and draws up a strategy for each. The strategy need not be the same across all companies or across all sectors. To ensure a realistic and successful course of action, the DM will have an Advisory Board. The Advisory Board will have as members, individuals who have sufficient capital market and international investor experience. Examples are representatives from financial institutions, management consultants, merger and acquisition (M&A) experts and private companies. It is important to ensure that the DM and politicians and bureaucrats involved in the disinvestment process are granted immunity from prosecution and investigation by the Central Bureau of Investigation (CBI) or Central Vigilance Commission (CVC). If the process is transparent, as is argued in this report, the need for these will not arise. In this framework, there is no need to revive the Disinvestment Commission. It has no further role to play. HOW MANY OF THESE JUSTIFICATIONS FOR PSUs ARE VALID NOW? v Infant industry v Heavy industry based development strategy v Right distribution of ownership of capital v Lack of resource v No technical competence in private sector v Under-developed capital market v Balanced regional development v Employment promotion v Protection Second, the candidates for disinvestment must be chosen carefully. Stronger PSUs are the ones that must enter the market first, in the immediate short run (the first four years). This will whet the appetite of investors and make India a success story, a phenomenon that tends to snowball. Creation of markets is in fact an indirect positive fallout of successful disinvestments. In the medium term however, all government companies that are non-strategic should be candidates for disinvestment. Strategic or core must be carefully defined. Other than arms, ammunition and defence equipment, atomic energy, radioactive minerals and railway transport, there is nothing else that can appropriately be defined as strategic or core. Therefore, in every other case, there is no reason why government equity should not be brought down to 26% and this includes banking, insurance, aviation, the petroleum sector and tourism. 26% equity is enough to ensure that the government has some influence over corporate decision making. The only caveat to 26% can be if prior privatization of management enhances valuation. The disinvestment process is best managed if there are a defined number of large transactions per year, as opposed to a large number of small transactions. Perhaps some overall restructuring of PSUs through mergers and acquisitions (or even winding up) is therefore necessary prior to disinvestment. Stated differently, one of the first decisions the DM has to take is on the extent of disinvestment. Will there be total disinvestment? Will there be partial disinvestment with managerial control retained by the State? Will managerial control be handed over to a strategic investor, with only minority share holding granted to such an investor? As the statements above indicate, this report argues for total disinvestment. The selling of bundles of portfolios of shares will not work. Moreover, selling lots of 5 or 10% is counterproductive because buyers know that further shares will be offered. The mindset that a PSU, even if does not make losses, is a going concern must change. Instead, the block of assets must be sold. Whether the enterprise will continue to be a going concern or not, is for the new management to decide. There is some urgency in doing this. Before liberalization, many PSUs were monopolies. They are now being exposed to competition. This process will intensify as further liberalization of trade (cuts in tariffs and elimination of quantitative restrictions) and investments (foreign direct investments) take place. To get a good value for these PSUs, the time to disinvest is now. Not later. Third, the present system of selecting lead managers on the basis of bidding for fees is entirely unsatisfactory. Second-best lead managers are chosen and are often not interested, or do not deliver their best resources, to issuances. Globally, there are only 5 or 6 top lead managers. All these should be empanelled and additions to this panel can be through co-managers from smaller investment banks. The norms for fees can be fixed and such norms can be suggested by a team of financial institutions that have requisite expertise. These empanelled lead managers can be allotted initial issuances in random fashion and further issuance mandates can be based on performance (over-subscription, market-making, pricing). All this will eliminate delays in the process of selecting lead managers. Fourth, the process of disinvestment need not be completely capital market driven, as it is today. The capital market focus, the small percentage of equity disinvested and an overall lack of clarity result in a less than optimum value being derived from the disinvestment process. There are nine, not mutually exclusive, options possible for the disinvestment process and PSU reform and all nine can be used to ensure flexibility and maximum value from disinvestments. Often, the choice may be dictated by whether the eventual shareholding is meant to be narrow or wide. These nine options are the following. First, there can be strategic majority sales to a partner and global trends show that there is more realizable value (about 20 to 30% more) through strategic sales to companies in the same sector. 51% or even 100% equity can be sold to such strategic buyers. Second, there can be open public auctions for units to bidders, with or without pre-qualifications. However, sales should not be only to public sector financial institutions and their subsidiary mutual funds. Third, there can be public sales through stock exchanges in the domestic capital market. One can continue with capital market disinvestments, except that larger shares of equity must be off-loaded through initial IPOs. It is necessary to privatize management before IPOs for value to be maximized. Global trends are that 20 to 30% more value is obtained through disinvestments after privatization of management than before privatization of management. Fourth, it is possible for PSUs to enter into joint ventures (JVs) with the private sector and transfer their business for stock in the new enterprise. However, in such cases, shareholder agreements between the private company and the PSU must over-ride government decision making or policy. Once the JV route has been followed, capital market transactions are possible. Fifth, GDRs/depository receipts can be issued in international capital markets.10 Sixth, as an imperfect framework of disinvestments, there can be management contracts for limited periods of time with private operators. Seventh, there can be sales in blocks. Eighth, despite all attempts at reform, there will be some clear cases of winding up. Ninth, there can be mergers and restructuring. For Central PSUs, this report later gives suggestions about what modality can be attempted for which PSU. Since employees and Indian citizens in general have to be part of the disinvestment process, employees must first be given up to 10% of stock at par or at discounts on market values. This can be spliced with deferred payment for employees and loyalty bonus of shares if shares are held for a minimum period. In addition, a small additional IPO or up to 10% of capital can be offered to Indian citizens in individual capacity. There can be a caveat that a single individual cannot have more than 1000 shares. This will eliminate some resistance to disinvestment and employees or others will become part of the process that creates more value for their company. PSUs will move from being employment creators for those who are employed with the company to enterprises that create wealth for their share-holders, the citizens of India. This is what should have happened with PSUs in the first place. In addition, it may be necessary to ensure that willing employees are provided attractive severance packages. Without the possibility of surplus manpower being shed, bids will be marked down. The role of a media campaign in generating consensus also needs to be emphasized. What is the need to privatize profit making PSUs? v Because it fetches better prices. v Unless an enterprise is in the strategic sector and unless the market structure is a monopoly, profit making is an argument for disinvestment – not an argument against it. There will continue to be a problem with loss-making PSUs, many of which historically are loss-making private sector enterprises that should have been closed down, but were nationalized in the 1970s. The Board for Industrial and Financial Reconstruction (BIFR) is supposed to examine these and recommend ones that cannot be revived. Not a single one has been closed down, primarily because of court intervention on labour grounds. While loss-making PSUs that have positive market value can be sold, this is also true of loss-making PSUs that have eroded their net worth,11 provided that the assets are sold as a block. There may be a few cases where actual closing down is necessary. Properly used, the National Renewal Fund (NRF) can be used to retrain and re-deploy people who are retrenched because of closing down. However, the NRF cannot be equated with a Voluntary Retirement Scheme (VRS). As originally stated, the NRF was supposed to be used for VRS, retraining and unemployment insurance. Only the first has come about. The proceeds of disinvestment should not go into the Consolidated Fund of India. They have to be used to retire the public debt or for a genuine NRF (from which Rs 1000 crore can be earmarked for VRS). In fact, the present value of future wage and pension flows of workers is easy to compute. From funds obtained through sales, this amount can be set aside, so that a worker who loses a job does not lose the income security. There has to be fresh legislation to ensure fast transfer or leasing of government land and user rights. This can even provide for special tribunals, without violating Article 14 of the Constitution. Otherwise, the entire process can get stuck in the court system. 10 In passing, there should be greater resort to the American Depository Receipt (ADR) route, which has greater depth and can therefore offer higher valuation. 11 A rough figure will be 60 at the Central level and at least 60 at the State level. 3. Sequence and transition For the entire mechanism and process to be credible, two units must be sold by 31 March 2000. Thereafter, there should be a clear target for the next two years. 12 billion US dollars over the next two-year time span is a reasonable target, that is, Rs 52,000 crores. It is not possible for this report to be specific about the time sequencing of disinvestment. However, some principles can be mentioned. First, there is urgency about sectors where monopoly is being threatened because of liberalization. Second, the government is generally bad in areas where there is a service orientation. Therefore, services, manufacturing and trading are sectors where the initial flush of disinvestments can take place. This emphasis on service orientation also explains why banks have to go first. Barring the strategic sectors, no more than 26% government equity need be retained. But in the interim period, the government might wish to continue as the single largest shareholder. Retaining government shareholding directly will constrain PSUs because of interference from government ministries, Parliament and government audits. Once government equity is below 50%, decisions on appointing management must be left to Boards and not to Joint Secretaries in administrative ministries. Another advantage of bringing equity down to 26% is avoidance of the Central Vigilance Commission (CVC), the Central Bureau of Investigation (CBI) and the Prevention of Corruption Act (PCA). Section 13 of the Prevention of Corruption Act defines that a public servant is guilty of criminal misconduct (corruption) if a decision taken by the public servant benefits a third party, unless it can be proved that this benefit to the third party is in the public interest. Any decision taken benefits a third party and it is impossible to prove that this benefit to the third party is in the public interest. Therefore, public servants become risk averse and don't take decisions. There is no point asking PSUs to function along commercial principles as long as such a section continues. Ideally, until the government shareholding is brought down to below 51%, there should be a National Shareholding Trust as a non-profit trust under the Societies Registration Act or the Companies Act. The entire government shareholding can be transferred to this Trust. On the advice of the DM, the Trust will sell equity in block sales to banks, financial institutions or mutual funds or directly to retail investors. In the interim, there can be a stipulation that shares held by the Trust will not drop below the 26% threshold. The Trust will be preferable to a Special Purpose Vehicle as it will take the enterprise out of the purview of the CVC, CBI, PCA, government ministries, Parliament and government audits. However, if this is not done and government shareholding is more than 50%, the enterprise must still explicitly be taken outside the CVC, CBI, PCA, government ministries, Parliament and government audits. The salaries paid to management must also be delinked from government salary structures. Management salaries have to be decided by boards and by no one else. There has to be a proper competition policy to cover unfair and restrictive trade practices and issues like transfer pricing. The competition policy must also cover mergers and acquisitions. At present, no prior approval is required for mergers and acquisitions, although that is the practice in many developed countries also. Subsequent de-monopolization through breaking up involves significant transaction costs. It is a better idea to require prior approval. One must also be careful in some service sectors. With many individual countries, service sector liberalization depends on reciprocity clauses – banking and aviation are examples. These may have to be renegotiated if government equity drops below 50%. Incidentally, there is no reason to exclude banking from disinvestments, although changes in the Banking Regulation Act will be necessary. Banks, when privatized, can have certain guidelines on lending for priority sectors. But these guidelines must be set out by the Reserve Bank in the offer letter itself, and not introduced subsequently. In line with these points, this report suggests the following modalities for Central PSUs. In the annexure table, "X" indicates that the route is appropriate for a PSU, the absence of "X" indicates that for that PSU, that route is not appropriate. 4. The road map

Indian RailwaysFrom Wikipedia, the free encyclopedia This article is about the organisation. For general information on railways in India, see Rail transport in India.

Indian Railways (reporting mark IR / भा. रे) is an Indian state-ownedenterprise, owned and operated by the Government of India through theMinistry of Railways. It is one of the world's largest railway networks comprising 115,000 km (71,000 mi) of track over a route of 65,000 km (40,000 mi) and 7,500 stations. In 2011, IR carried over 8,900 million passengers annually or more than 24 million passengers daily (roughly half of which were suburban passengers) and 2.8 million tons of freight daily. In 2011–2012 Indian Railways had revenues of Railways were first introduced to India in 1853 from Bombay to Thane. In 1951 the systems were nationalised as one unit, the Indian Railways, becoming one of the largest networks in the world. IR operates both long distance andsuburban rail systems on a multi-gauge network of broad, metre and narrowgauges. It also owns locomotive and coach production facilities at several places in India and are assigned codes identifying their gauge, kind of power and type of operation. Its operations cover twenty nine states and seven union territories and also provides limited international services to Nepal, Bangladeshand Pakistan. Indian Railways is the world's ninth largest commercial or utility employer, by number of employees, with over 1.4 million employees. As for rolling stock, IR holds over 239,281 Freight Wagons, 59,713 Passenger Coaches and 9,549Locomotives (43 steam, 5,197 diesel and 4,309 electric locomotives). The trains have a 5 digit numbering system as the Indian Railways runs about 10,000 trains daily. As of 31 March 2013, 23,541 km (14,628 mi) (36%) of the total 65,000 km (40,000 mi) route length was electrified.[4] Since 1960, almost all electrified sections on IR use 25,000 Volt AC traction through overhead catenary delivery. On 23 April 2014, Indian Railways introduced a mobile app system to track train schedules.[5] ContentsHistory[edit]Main article: History of rail transport in India The history of rail transport in India began in the mid-nineteenth century. The core of the pressure for building Railways In India came from London. In 1848, there was not a single kilometre of railway line in India. A British engineer, Robert Maitland Brereton, was responsible for the expansion of the railways from 1857 onwards. The Allahabad-Jabalpur branch line of the East Indian Railway had been opened in June 1867. Brereton was responsible for linking this with the Great Indian Peninsula Railway, resulting in a combined network of 6,400 km (4,000 mi). Hence it became possible to travel directly fromBombay to Calcutta. This route was officially opened on 7 March 1870 and it was part of the inspiration for French writer Jules Verne's book Around the World in Eighty Days. At the opening ceremony, the Viceroy Lord Mayo concluded that "it was thought desirable that, if possible, at the earliest possible moment, the whole country should be covered with a network of lines in a uniform system".[6] By 1875, about £95 million were invested by British companies in India guaranteed railways.[7] By 1880 the network had a route mileage of about 14,500 km (9,000 mi), mostly radiating inward from the three major port cities of Bombay, Madras andCalcutta. By 1895, India had started building its own locomotives, and in 1896, sent engineers and locomotives to help build the Uganda Railways. In 1900, the GIPR became a government owned company. The network spread to the modern day states of Ahom Kingdom, Rajputhana and Madras Presidencyand soon various autonomous kingdoms began to have their own rail systems. In 1905, an early Railway Board was constituted, but the powers were formally vested under Lord Curzon.[8] It served under the Department of Commerce and Industry and had a government railway official serving as chairman, and a railway manager from England and an agent of one of the company railways as the other two members. For the first time in its history, the Railways began to make a profit. In 1907 almost all the rail companies were taken over by the government. The following year, the first electric locomotive made its appearance. With the arrival of World War I, the railways were used to meet the needs of the British outside India. With the end of the war, the railways were in a state of disrepair and collapse. In 1920, with the network having expanded to 61,220 km (38,040 mi), a need for central management was mooted by Sir William Acworth. Based on the East India Railway Committee chaired by Acworth, the government took over the management of the Railways and detached the finances of the Railways from other governmental revenues. The period between 1920 and 1929, was a period of economic boom; there were 41,000 mi (66,000 km) of railway lines serving the country; the railways represented a capital value of some 687 million sterling; and they carried over 620 million passengers and approximately 90 million tons of goods each year.[9] Following the Great Depression, the railways suffered economically for the next eight years. The Second World War severely crippled the railways. Starting 1939, about 40% of the rolling stock including locomotives and coaches was taken to the Middle East, the railways workshops were converted to ammunitions workshops and many railway tracks were dismantled to help the Allies in the war. By 1946, all rail systems had been taken over by the government. Organisational structure[edit]Main article: Indian Railway organisational structure Railway zones[edit]Indian Railways is divided into several zones, which are further sub-divided into divisions. The number of zones in Indian Railways increased from six to eight in 1951, nine in 1952 and sixteen in 2003 and now seventeen.[10][11] Each zonal railway is made up of a certain number of divisions, each having a divisional headquarters. There are a total of sixty-eight divisions.[3][12] Each of the seventeen zones is headed by a general manager who reports directly to the Railway Board. The zones are further divided into divisions under the control of divisional railway managers (DRM). The divisional officers of engineering, mechanical, electrical, signal and telecommunication, accounts, personnel, operating, commercial, security and safety branches report to the respective Divisional Manager and are in charge of operation and maintenance of assets. Further down the hierarchy tree are the station masters who control individual stations and the train movement through the track territory under their stations' administration.

Recruitment and training[edit]Main article: Centralised Training Institutes of the Indian Railways Staff are classified into gazetted (Group 'A' and 'B') and non-gazetted (Group 'C' and 'D') employees.[14] The recruitment of Group 'A' gazetted employees is carried out by the Union Public Service Commission through exams conducted by it.[15] The recruitment to Group 'C' and 'D' employees on the Indian Railways is done through 20 Railway Recruitment Boards and Railway Recruitment Cells which are controlled by the Railway Recruitment Control Board (RRCB).[16] The training of all cadres is entrusted and shared between six centralised training institutes. Production units[edit]Indian Railways manufactures much of its rolling stock and heavy engineering components at its six manufacturing plants, called Production Units, which are managed directly by the Ministry. Popular rolling stock builders such as CLW andDLW for electric and diesel locomotives; ICF and RCF for passenger coaches are Production Units of Indian Railways. Over the years, Indian Railways has not only achieved self-sufficiency in production of rolling stock in the country but also exported rolling stock to other countries. Each of these production units is headed by a general manager, who also reports directly to the Railway Board. The production units are:-

Other subsidiaries[edit]There also exist independent organisations under the control of the Railway Board for electrification, modernisation,research and design and training of officers, each of which is headed by an officer of the rank of general manager. A number of Public Sector Undertakings, which perform railway-related functions ranging from consultancy to ticketing, are also under the administrative control of the Ministry of railways. There are fourteen public undertakings under the administrative control of the Ministry of Railways,[17] viz.

Delhi Metro Rail Corporation Limited (DMRC), that has constructed and operates Delhi Metro network, is an independent organisation not connected to the Indian Railways. Similar metro rail corporations in other cities (except Kolkata Metro inKolkata) are not connected to the Indian Railways. Rolling stock[edit]Locomotives[edit]Main article: Locomotives in India Locomotives in India consist of electric and diesel locomotives. Biodiesel locomotives are also being used on experimental basis.[19] Steam locomotives are no longer used, except in heritage trains. In India, locomotives are classified according to theirtrack gauge, motive power, the work they are suited for and their power or model number. The class name includes this information about the locomotive. It comprises 4 or 5 letters. The first letter denotes the track gauge. The second letter denotes their motive power (Diesel or Electric) and the third letter denotes the kind of traffic for which they are suited (goods, passenger, mixed or shunting). The fourth letter used to denote locomotives' chronological model number. However, from 2002 a new classification scheme has been adopted. Under this system, for newer diesellocomotives, the fourth letter will denote their horsepower range. Electric locomotives don't come under this scheme and even all diesel locos are not covered. For them this letter denotes their model number as usual. A locomotive may sometimes have a fifth letter in its name which generally denotes a technical variant or subclass or subtype. This fifth letter indicates some smaller variation in the basic model or series, perhaps different motors, or a different manufacturer. With the new scheme for classifying diesel locomotives (as mentioned above) the fifth item is a letter that further refines the horsepower indication in 100 hp increments: 'A' for 100 hp, 'B' for 200 hp, 'C' for 300 hp, etc. So in this scheme, a WDM-3A refers to a 3100 hp loco, while a WDM-3D would be a 3400 hp loco and WDM-3F would be 3600 hp loco. Note: This classification system does not apply to steam locomotives in India as they have become non-functional now. They retained their original class names such as M class or WP class. Diesel Locomotives are now fitted with Auxiliary Power Units which saves nearly 88% of Fuel during the idle time when train is not running.[20] Goods wagons or freight cars[edit]The number of freight car or goods wagons was 205,596 on 31 March 1951 and reached the maximum number 405,183 on 31 March 1980 after which it started declining and was 239,321 on 31 March 2012. The number is far less than the requirement and the Indian Railways keeps losing freight traffic to road. Indian Railways carried 93 million tonnes of goods in 1950–51 and it increased to 1010 million tonnes in 2012–13.[21] However, its share in goods traffic is much lower than road traffic. In 1951, its share was 65% and the share of road was 35%. Now the shares have been reversed and the share of railways has declined to 30% and the share of road has increased to 70%. Passenger coaches[edit]Indian railways has several types of passenger coaches. Electric Multiple Unit (EMU) coaches are used for suburban traffic in large cities – mainly Mumbai, Chennai, Delhi, Kolkata, Pune, Hyderabad and Bangalore. These coaches numbered 7,793 on 31 March 2012. They have second class and first class seating accommodation. Passenger coaches numbered 46,722 on 31 March 2012. Other coaches (luggage coach, parcel van, guard's coach, mail coach, etc.) numbered 6,560 on 31 March 2012. Freight[edit]Indian Railways earns about 70% of its revenues from freight traffic (Rs. 686.2 billion from freight and Rs. 304.6 billion from passengers in 2011–12). Most of its profits come from transporting freight, and this makes up for losses on passenger traffic. It deliberately keeps its passenger fares low and cross-subsidises the loss-making passenger traffic with the profit-making freight traffic. Since the 1990s, Indian Railways has stopped single-wagon consignments and provides only full rake freight trains Wagon types[edit]Wagon types include:[22]

Technical details[edit]Track and gauge[edit]Indian railways uses four gauges, the 1,676 mm (5 ft 6 in) broad gauge which is wider than the 1,435 mm (4 ft 81⁄2 in)standard gauge; the 1,000 mm (3 ft 33⁄8 in) metre gauge; and two narrow gauges, 762 mm (2 ft 6 in) and 610 mm (2 ft). Track sections are rated for speeds ranging from 75 to 160 km/h (47 to 99 mph). The total length of track used by Indian Railways is about 115,000 km (71,000 mi) while the total route length of the network is 65,000 km (40,000 mi).[23] About 23,541 km (14,628 mi) or 36% of the route-kilometre was electrified as on 31 March 2013.[4] Broad gauge is the predominant gauge used by Indian Railways. Indian broad gauge—1,676 mm (5 ft 6 in)—is the most widely used gauge in India with 105,000 km (65,000 mi) of track length (91% of entire track length of all the gauges) and 56,000 km (35,000 mi) of route-kilometre (86% of entire route-kilometre of all the gauges). In some regions with less traffic, the metre gauge (1,000 mm (3 ft 33⁄8 in)) is common, although the Unigauge project is in progress to convert all tracks to broad gauge. The metre gauge has about 8,000 km (5,000 mi) of track length (7% of entire track length of all the gauges) and 7,000 km (4,300 mi) of route-kilometre (10% of entire route-kilometre of all the gauges). The Narrow gauges are present on a few routes, lying in hilly terrains and in some erstwhile private railways (on cost considerations), which are usually difficult to convert to broad gauge. Narrow gauges have 2,000 route-kilometre. The Kalka-Shimla Railway, the Kangra Valley Railway and the Darjeeling Himalayan Railway are three notable hill lines that use narrow gauge, but the Nilgiri Mountain Railway is a metre gauge track.[24] These four rail lines will not be converted under the Unigauge project. The share of broad gauge in the total route-kilometre has been steadily rising, increasing from 47% (25,258 route-km) in 1951 to 86% in 2012 whereas the share of metre gauge has declined from 45% (24,185 route-km) to 10% in the same period and the share of narrow gauges has decreased from 8% to 3%. About 21,500 route-km of Indian railways is electrified. Sleepers (ties) are made up of prestressed concrete, or steel or cast iron posts, though teak sleepers are still in use on a few older lines. The prestressed concrete sleeper is in wide use today. Metal sleepers were extensively used before the advent of concrete sleepers. Indian Railways divides the country into four zones on the basis of the range of track temperature. The greatest temperature variations occur in Rajasthan. Research and development[edit]In August 2013, Indian Railways entered into a partnership with Indian Institute of Technology (Madras) to develop technology to tap solar energy for lighting and air-conditioning in the coaches. This would significantly reduce the fossil fuel dependency for Indian Railways.[25] Recently it ingeniously developed and tested the Improved Automated Fire Alarm System in Rajdhani Express Trains. This System would now be applied to AC coaches of all regular trains.[26] Railway links to adjacent countries[edit]Existing rail links:

Under construction / Proposed links:

Types of passenger services[edit]Trains are classified by their average speed.[30] A faster train has fewer stops ("halts") than a slower one and usually caters to long-distance travel.

Accommodation classes[edit]Main article: Indian Railways coaching stock Indian Railways has several classes of travel with or without airconditioning. A train may have just one or many classes of travel. Slow passenger trains have only unreserved seating class whereas Rajdhani, Duronto, Shatabdi, garib rath and yuva trains have only airconditioned classes. The fares for all classes are different with unreserved seating class being the cheapest. The fare of Rajdhani, Duronto and Shatabdi trains includes food served in the train but the fare for other trains does not include food that has to be bought separately. In long-distance trains a pantry car is usually included and food is served at the berth or seat itself. Luxury trains such as Palace on Wheels have separate dining cars but these trains cost as much as or more than a five-star hotel room. A standard passenger rake generally has four unreserved (also called "general") compartments, two at the front and two at the end, of which one may be exclusively for ladies. The exact number of other coaches varies according to the demand and the route. A luggage compartment can also exist at the front or the back. In some mail trains a separate mail coach is attached. Lavatories are communal and feature both the Indian style as well as the Western style. The following table lists the classes in operation. A train may not have all these classes.

At the rear of the train is a special compartment known as the guard's cabin. It is fitted with a transceiver and is where the guard usually gives the all clear signal before the train departs. UNESCO World Heritage Sites[edit]There are two UNESCO World Heritage Sites on Indian Railways. – The Chatrapati Shivaji Terminus[33] and the Mountain Railways of India. The latter consists of three separate railway lines located in different parts of India:[34]

Notable trains[edit]Tourist trains[edit]

Other trains[edit]

Problems and issues[edit]

The personnel costs and operating costs have increased several times over the past decade. Fares have been hiked both in 2011 and 2013, offsetting a good percentage of the loss.[47] The maintenance of passenger coaches and goods wagons is poor and often results in derailments and other accidents. The sanitation in trains and stations is improving. Trains like Duronto/Rajdhani & some express trains such as Hyderabad to Bangalore Kacheguda Express have onboard janitors, whose job it is to clean to compartment and washrooms on a regular basis. Further, mobile numbers of supervisors are provided on the train for any complaints. New railway line projects are often announced without securing additional funding for them. A large number of these projects are not profitable and do not get completed within the scheduled time. As on 31 March 2011, 347 projects including new lines, doubling and gauge conversion were pending and their costs have increased to See also[edit]

References[edit]

Notes[edit]

External links[edit] | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

No comments:

Post a Comment