Troubled Galaxy Destroyed Dreams, chapter 432

Palash Biswas

http://indianholocaustmyfatherslifeandtime.blogspot.com/

| Republic of silence |

| P.V. Narasimha Rao's forgotten promise |

| Hokum must have its kingdom. The judicial report on the culpability for the crime perpetrated on December 6, 1992, was first leaked and then laid on the floor of Parliament. The predictable sequel was an uproarious parliamentary debate. Countrymen ar... | Read.. |

Not Your Grandfather's Climate SummitCBS News (blog) - - 1 hour ago But as he arrived at the UN summit on climate change, the President warned, "The world's ability to take collective action on global warming is in doubt. ... Split on climate summitCentral Chronicle - 2 hours ago A split amongst the nations has been persisting in the Copenhagen climate summit instead of making a headway to attain any cogent goal. ... Copenhagen summit fizzling out Hindustan Times Climate summit returning to track after worst phasesMerinews - 3 hours ago SERIOUS DIFFERENCES between the developed and developing countries had almost put the United Nations Climate Summit here in Denmark capital on the verge of ... India stands with developing world at climate summit Hindustan Times India flexible, US dangles dollars Calcutta Telegraph Climate talks back on track: Jairam Ramesh Daily News & Analysis Climate summit: nothing but 'hot air'euronews - 51 minutes ago The climate change summit is being accused of producing nothing but hot air, as two weeks of talks in Copenhagen stood on the brink of failure. ... In the final hours, can 'the Titanic' be saved? Sydney Morning Herald Presenting, HT's stars of the summit Hindustan Times In Copenhagen, the New Radicals TheTyee.ca Greenpeace trio charged over climate summit dinner stuntHerald Sun - 4 hours ago DANISH police today laid charges against three Greenpeace activists who gatecrashed a royal gala dinner for heads of state at the UN climate summit. ... Greenpeace spectacularly crashes Queen's dinner party at Copenhagen Climate summit Greenpeace UK (blog) Greenpeace Delivers Message To World Leaders Scoop.co.nz (press release) Harper, other leaders under pressure to do a deal as climate summit winds downThe Canadian Press - 5 hours ago But a draft text had yet to emerge as the clock ticked down to the summit's close. An agreement, should there be one, was expected to be only a few pages in ... PM keeps low profile at UN climate talks Toronto Star Prentice delivers Canada's unpopular position Globe and Mail Harper passes on address Toronto Sun PM arrives in Copenhagen to attend Climate SummitHindustan Times - 19 hours ago ... a minor US concession and a truce between squabbling nation blocs today allowed some crumbs to be salvaged from the Copenhagen climate summit. ... Local governments fight climate changeREVE - 6 hours ago With this Copenhagen Climate Summit for Mayors, we have proved for the first time that through resolute cooperation between national and local governments ... World's mayors gather at climate summit The Associated Press Kaklamanis at climate summit Athens News Agency Mayors say private money is the answer The COP15 Post Mugabe demands Cash, dismiss Human Rights at Copenhagen Climate SummitZimEye - - 9 hours ago Was it the prospect of big financial windfall to developing nations that drove Mugabe to attend the UN Climate Change Summit in Copenhagen. ... World leaders flock to Copenhagen Sydney Morning Herald World leaders head for Copenhagen climate summit - Summary Earthtimes (press release) Stay up to date on these results: |

The Carbon Trading Global Business meeting place, Project Center and Auction

Where Carbon Trading, Carbon Brokers, Carbon Credits Trading, Carbon Farming, Carbon Prices are Found, Carbon credits are Traded

Meet on a Global scale to form the Carbon Market

Environment

Jul 20, 2004

Indian villages in global carbon trading

About two years ago when GoodNewsIndia reported that an Indian company was ready to export carbon credits, it had seemed a very savvy, avant-garde move. Now Indian villages have hurried along, ahead of many Indian corporates. A most appropriately named village, Powerguda in Adilabad district Andhra Pradesh has pioneered a sale to the World Bank for $645.

The village was selling 147 tonnes equivalent of saved carbon dioxide credits. What are carbon credits and what is carbon trading? Quoting from the above cited article: "Let's rewind to the Kyoto Protocol of 1997 by which all countries are required to reduce their greenhouse gas emissions by 5% --from 1990 levels-- in the next ten years, ie 2012—or pay a price to those that do." The idea is, that if a country is a consumer of an environmental value like clean air, it must pay a producer of an equivalent value.

Powerguda's claim of having saved 147 MT of CO2 is based on the bio-diesel they extracted from 4500 Pongamia trees in their village. Using this —instead of petroleum—in oil engines would enhance air quality. World Bank in a behaviour model worth emulating by other corporates, was buying those carbon credits to balance the aviation fuel burnt by aircraft carrying Bank officials.

Mr Emmanuel D'Silva, a former World Bank staffer has been working extensively among Andhra Pradesh villagers, creating awareness about this market opportunity that awaits them. In a communication to GoodNewsIndia in June,2004 he reports that five other villages have followed Powerguda and made carbon credit sales.

Mr Nalin Kishor of the World Bank who heads the programme has kindly permitted the article in the following page, to be reproduced for GoodNewsIndia's readers. It originally appeared at the Profor site.

http://www.goodnewsindia.com/index.php/Supplement/article/385/

Oct 23, 2002

Carbon Trading arrives in India

When GoodNewsIndia interviewed Dr.U.Shrinivasa for the Bio-diesel story and he held forth on the coming market for Carbon Trading, it had seemed futuristic. But it has already arrived in India with Jindal Vijaynagar Steel declaring itself ready to sell $225 million worth of saved carbon over the next 10 years.

Well, what is Carbon Trading? Let's rewind to the Kyoto Protocol of 1997 by which all countries are required to reduce their greenhouse gas emissions by 5% --from 1990 levels-- in the next ten years, ie 2012—or pay a price to those that do. The idea was to make developed countries pay for their wild ways with emissions while at the same time monetarily rewarding countries with good behaviour in this regard. Since developing countries can start with clean technologies, they will be rewarded by those stuck with 'dirty' ones. Say a company in India can prove it has prevented the emission of x-tonnes of carbon, it can sell this good carbon-karma to a company in say, the US which has a bad karma. An environment-fundamentalist may say it's all a bit like an indulgent epicure paying someone else to diet for him, but then that's another story. Right now, there is a market opportunity for India—but only till 2012. Closer to that clean-up date prices of carbon credits will rise and in the years leading up to it there will be a scramble to buy credits cheap. The World Bank has built itself a role in this market as a referee, broker and macro-manager of international fund flows. The scheme has been entitled Clean Development Mechanism [CDM] in 2000. Or more commonly, Carbon Trading.

Jindal on Oct 19, said that the Corex furnace technology that it employs would prevent 15 million tonnes of carbon from being discharged into the atmosphere in the coming decade. At a sale price of $15/tonne that is a total of $225 million. Jindal says companies from the Netherlands, Canada, the US and Japan have begun talking to it. On Oct 22, the New Indian Express carried a story that said the World Bank had just handed over $10 million to India's Infrastructure Development Finance Company to fund 'clean' projects that would generate saleable carbon credits. The carbon market is here.

Dr. Srinivasa had imagined a role for rural India in this emerging market. He said that power generated by naturally grown fuels would yield carbon credits and revenue from their sale should be factored into, when evaluating a bio-diesel future. Will we do it before the carbon market closes? If we could, would not bio-diesel power be unbeatable economics?

Carbon trading

From Wikipedia, the free encyclopedia

Carbon trading may refer to:

Carbon trading - Wikipedia, the free encyclopedia

From Wikipedia, the free encyclopedia. Jump to: navigation, search. Carbon trading may refer to: Carbon emission trading · Personal carbon trading ...

en.wikipedia.org/wiki/Carbon_trading - Cached - Similar -Carbon Trading,Carbon Credits, Carbon Farming, Carbon Market

Indian villages in global carbon trading

The village was selling 147 tonnes equivalent of saved carbon dioxide credits. What are carbon credits and what is carbon trading? ...

www.goodnewsindia.com/index.php/Supplement/.../385/ - Cached - Similar -Carbon Trading arrives in India

Carbon Trading arrives in India. When GoodNewsIndia interviewed Dr.U.Shrinivasa for the Bio-diesel story and he held forth on the coming market for Carbon ...

www.goodnewsindia.com/index.php/Supplement/.../320/ - Cached - Similar -What Is Carbon Trading?

9 Oct 2009 ... "Carbon Trading" is still in its nascent phase, but the kind of growth this market is experiencing is tremendous and that is what makes it ...

blogs.expressindia.com › Blogs - Cached - Similar -- [PDF]

CLEAN DEVELPOMENT MECHANISM (CDM) AND CARBON TRADING IN INDIA

File Format: PDF/Adobe Acrobat - Quick View

more commonly, Carbon Trading. CDM PROJECT TYPES. Carbon Credits are sold to entities in Annex-I countries, like power utilities, who have emission ...

www.tce.co.in/Downloads/bro_pdf/.../cdm_carbon_trading.pdf - Similar - Global warming: Carbon trading not enough

20 Mar 2009 ... Whatever carbon trading may have achieved till now, recent trends have ... In the current economic situation, carbon trading needs to be ...

www.rediff.com › ... › Business › Columnists › Guest Column - Cached - Similar -Carbonfreezone - What is Carbon Trading?

iwant to ask about carbon trading is benefiting the oil industry or no and ... hey m student from india... i want to know if we do carbon trading the how ...

www.carbonfreezone.com/CarbonTrading.aspx - Cached - Similar -Carbon trading won't stop climate change - opinion - 20 April 2009 ...

In 2005 the European Union created the world's first proper carbon market, the EU Emissions Trading Scheme (ETS), which compels highly polluting industries ...

www.newscientist.com/.../mg20227046.200-carbon-trading-wont-stop-climate-change.html - Cached - Similar -News results for Carbon Trading

Blow for clean coal as UN shuts it out of emissions trading - 1 day ago

A new report by Point Carbon showed this week that inadequate project ... under the United Nations' carbon-trading system fail to deliver any benefits. ...Telegraph.co.uk - 62 related articles »

Can carbon trading markets really work? - BBC News - 21 related articles »

| Searches related to Carbon Trading | |||

| carbon credits | personal carbon trading | carbon trading companies | carbon trading price |

| carbon trading pdf | carbon trading jobs | cdm | carbon footprint |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next |

Finnair moots global body to govern emission tradeBusiness Standard - 4 hours ago "There is absence of any definite system to calculate emission trading. We feel that there should be a global body, preferably under the United Nations to ... Copenhagen Climate Conference: Just one more day to seal the dealGreenfudge.org (blog) - - 6 hours ago Add to that the "positive" consequences of the economic crisis on carbon emissions as well as the current carbon trading structures and Europe is "almost ... EU succeeding in green commerce Atlanta Journal Constitution Can carbon trading markets really work?BBC News - Dec 15, 2009 The outcome some want to see from the climate change talks in Copenhagen, is a broadening of the market which trades in carbon dioxide or CO2 emissions. ... Cap & Trade: A Critical Look at Carbon Trading Democracy Now Countering the critics of Annie Leonard's `The Story of Cap and Trade' Links International Journal of Socialist Renewal Carbon traders worried by lack of dealCCTV - - 1 hour ago As a major player in the emerging field of carbon trading with registered capital assets of several hundred million euros, the company buys carbon emissions ... Alternative US carbon trading scheme unveiledStock and Land - 16 hours ago ... of moderate lawmakers who like the idea of capping carbon emissions but are opposed to creating a new financial market for trading emissions permits. ... Cap and dividend could break logjam Financial Post Blow for clean coal as UN shuts it out of emissions tradingTelegraph.co.uk - - Dec 16, 2009 ... inadequate project preparation means almost one third of all the projects under the United Nations' carbon-trading system fail to deliver any benefits. ... CCM lands new partnerNational Post - - 7 hours ago But those plans, formed near the end of 2007, had to deal with the collapse of the financial markets and a push-back of regulations regarding carbon trading ... HTC Purenergy acquires Carbon Capital Management Inc. from Front Street Capital Winnipeg Free Press HTC Purenergy Inc. Announces the Acquisition of Front Street Capital's "Carbon ... Market Wire (press release) Carbon Trading In China Expected To Become More Important In The Coming YearsChina Newswire (press release) - 5 hours ago More than 40 leading professionals from the carbon trading sector will deliver speeches on the Next-step Action after COP 15. Some of them come from UNFCCC ... Report explores trends in software for managing emissions and carbon trading ...ZDNet (blog) - - 5 hours ago The angle that UtiliPoint takes it that there will be two distinct categories that emerge: one to handle carbon activities in much the way that a business ... Nifty holds 5000 DLF Unitech Bharti downMoneycontrol.com - Dec 16, 2009 At 13.18 hrs IST, the Nifty was trading in a narrow band of 5010-5050. The Nifty has struggled to find decisive breakout in either direction for almost two ... | |

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Next |

Will carbon trading work?

- Carbon trading lacks a global platform and accounting standard

- The factors complicating accurate carbon-trading reportage begins with the "product" --an invisible gas.

- More than 30 countries worldwide have or are planning a carbon trading market

(CNN) -- Carbon trading -- with its mix of free-market principles and government regulation -- holds global appeal as a way for businesses to reduce emissions. But lack of a global market for carbon trade and questions over surveillance and accounting for pollution offsets raises questions about its viability.

The factors complicating accurate carbon-trading reportage begins with the "product" -- in this case the absence of an invisible gas. Adding to the intangibility is the crediting of businesses for projected reductions in greenhouse gas emissions.

"They are a tricky beast -- an environmental commodity is not a natural private good, like a tube of toothpaste or a haircut," said Michael Gillenwater, dean of the Greenhouse Gas Management Institute, in an interview earlier this year.

"You can just look in the mirror to tell if a haircut is a good product... in carbon trading, it's just a piece of paper, a record in a database and the trust that it really does represent a truthful accounting of emissions," he said.

Carbon trading uses a stick-and-carrot approach to reduce the gases that cause global warming. The stick: Governments cap total emissions and require pricey permits and hefty fines for emissions. The carrot: Industry finds ways to reduce emissions to decrease costs and with leftover polluting allocations sell to the highest bidder on the open market.

Video: What is carbon trading?

Video: What is carbon trading? Carbon trading allows companies to pollute up to a point -- but, in theory, the total amount of pollution should be less than current levels. More than 30 countries worldwide have or are planning a carbon trading market.

For carbon trading to really work, however, the market needs to be worldwide, said Louis Redshaw of Barclays Capital.

"The U.S. is close, not close enough, but getting closer to implementing cap and trades. Japan is doing the same thing.," Redshaw said. "South Korea, even, are going to follow what Japan does."

Carbon trading legislation -- facing party opposition and energy industry pressure --recently failed to pass the Australian Senate earlier this month, causing a political fracas for Prime Minister Kevin Rudd and the ruling Labor government. The government plans to reintroduce the legislation in February.

The European Union is home to the biggest emissions trading system, but that has been subject to complaints that too many pollution permits have been issued.

"Carbon trading on its own can't save the planet," said Robert Rabinowitz of the European Climate Exchange. "Carbon trading can help make the process cheaper, but only if the politicians set sufficiently ambitious targets."

This is a worry since the carbon trading market as pollution joins the ranks of other tradable commodities such as coal and natural gas.

The global market for carbon trading was "vulnerable to Enron type accounting scandals" because of the lack of global standards on emissions accounting and qualified professionals to account for those changes, according to the "2009 Greenhouse Gas/Climate Change Workforce Needs Assessment Survey" released earlier this year.

"Any crediting involving projections are inherently uncertain and vulnerable to manipulation by the unscrupulous," said the report, a global survey of industry professionals and policy makers by Greenhouse Gas Management Institute and Sequence Staffing.

http://www.cnn.com/2009/BUSINESS/12/14/carbon.trading.explainer/index.html?section=cnn_latest

I quarelled at Home, in the Train and at my Work Place as Misinformed people assume to know Everything. Bengal assembly passed the Creamy Layer Bill last week setting Rs Eighteen Thousand.It means the persons belonging to SC, OBC and ST communities would not have the benefits of reservation once they cross the limit of Rs.eighteen thousand . At least three mainstream Bengali Daily AAZLKAL, Bartaman and Bangla Statesman carried the news and and it has not been CONTACTED at any level specially when Mamata Bannerjee has Succeeded to break the Solid SC, ST and OBC as well as Muslim bases and the news is bound to create tremors. I am getting phone calls from all over Bengal enquiring the details. The Assembly Proceedings have not listed the Bill in schedule or the minutes of the debate or noted the Passing of the Bill. Our Friends in Indian PSUsFDI ceiling has been abolished even in Defence sector, but the Defence Correspondent claims that I may not know the TRUTH or failed to understand the TRUTH. In Accordance to the Senior Scribe, Political Parties in The Parliament would Never ALLOW it! While the most Informed Journalists happen to be so IGNORANT, how the Masses would know the Truth!

At Home, my wife Sabita was agitated with the news items published on Climate Change and Global Warming. I tried to convince the Environment Economics and sponsored Media feed back as Barrack Obama landed in COPENHAGEN!Corporate World is camping in the Summit venue and bargaining hard to get the DEAL STRUCK . Defending the Corporate interest, the Developed nations propose to fund amounting Hundred Crorear quite agitated that since the Political parties and Media, Intelligentsia and NGOs pursue the World Bank and IMF Policies, why should I stand in ALIENATION!

Ravi Bhushan from Ranchi asked me the names of the Economists who stand against Economic Reforms and ethnic Cleansing, I could not Pronounce a Single name! May you enlighten!

Om Thanvi , the Executive Editor of Janasatta reported from COPENHAGEN about the Activities of Corporates and MNCs and the Failure of the Environment Activists! But I could not get any feed back from any Toilet News Paper. Since Jansatta works as an ALTERNATIVE media at least in its Edit Page, OM Thanvi continued to report the TRUTH in Excellent language. I avoid the Manager Editor, but whenever he writes it is a delight for READING! My wife did not read the report.

In the Train , a RSS affiliated person was following us since last month. He demanded that I should speak on the Myth. he specially wished that the MAHABHARAT Myth should be discussed. The Compartment was in dark as Mamata flashed the White Paper in the Parliament dismissing Lalu`s claims for Profit in railway. The White paper Smashed the STATICS and Facts catered till this date. We were already discussing the topic.Meanwhile a hawker inserted the Cricket scores an the Rhythm was Broken. I humbly told the man that I am not a Professional Preacher or Ballade singer. He insisted. I discussed how the Myths are created and broken quoting Hitler, Rama, and Paradise Lost. Then I related the matter with DEMONISING and Iconising as well as with branding the Indigenous Aboriginal communities as EXTREMIST, Terrorist and Maoists! The man simply asserted that Bengal Never Existed before the Sen Dynasty! Then he inserted that the Sikh Refuges were not Resettled and all the Refugees coming from East Bengal had been FAMINE Struck as Nehru and BC Roy dealt with them with the same Policy! he justified partition and held east Bengla Muslims responsible for it. I was STUNNED. But he DE TRAINED on the next station BURRA Bazar and I could not reply!

Developed nations should deliver on Kyoto Protocol, says Manmohan Singh!While, Danish hosts re-launched U.N. climate talks on Thursday after the United States backed a 100 billion US dollar global fund to support poor countries and world leaders gathered for a final effort to reach a deal.

On the other hand, United States President Barack Obama on Friday said that his country was prepared to meet the responsibility of the largest economy and appealed to all members at the summit to act together and be accountable.

Obama gave a general call to live up to mutual obligation for the climate.

During his 5-minutes speech at the Heads of State meet over climate change in the Danish capital, Barack Obama said: "We are convinced the energy must be used efficiently. We all would be safer, if we act together and be accountable."

"We must live upto mutual obligations," he added.

Saying the U.S. intends to meet its share of responsibility as the largest economy, Obama said: "We intend to meet responsibility of the largest economy," and in that regard he said: "We (U.S.) have committed 10 billion dollars by 2012 as funds."

Obama said that the world must have a mechanism to see that everyone is doing enough and properly towards emission cuts. " But it should not be intrusive or infringing upon anyone's sovereignty."

The U.S. President agreed in his address that the developed countries should provide funds to the developing nations to enable them meet responsibilities related to mitigation of Greenhouse gases.

"We must give financial help for the developing nations, particularly the least developed countries," said Obama.

Obama, however, remarked on developing nations' rigidity in their position that asks the developed nations to support the developing economies by providing funds to enable them cut gas emissions: "The developing nations want aid with no accountability," he said.

Amid no signs of a breakthrough, Prime Minister Manmohan Singh said on Friday that the outcome of the Copenhagen climate summit may fall short of expectations and warned against any dilution of the principles of UNFCCC, particularly of "common but differentiated" responsibilities.

Addressing the crucial final day of the summit, the Prime Minister emphasised that India will deliver on its voluntary target of reducing the emission intensity of GDP growth by around 20 per cent by 2020 as compared to 2005 regardless of the outcome of the conference.

"We can do even more if a supporting global climate regime is in place," he told a galaxy of world leaders who have gathered to seal a climate deal in the Danish capital.

"The outcome (of the summit) may well fall short of our expectations," 77-year-old Singh said and favoured "subsequent negotiations towards building a truly global and genuinely collaborative response to climate change being concluded during the year 2010."

"We have a difficult task ahead of us. I hope we will play a positive and constructive role so that we bridge our differences and come out with a balanced and an equitable outcome in the coming years. India will not be found wanting in this," he said.

Singh also pointed out that majority of the countries do not support any renegotiation or dilution of the principles of UNFCCC, particularly common but differentiated responsibilities.

Meanwhile,Union Minister of State for Environment and Forests Jairam Ramesh reiterated that India doing everything in consultation with the BASIC group and there is not a question of India moving or India accepting.

Interacting with the Indian journalists on the sidelines of the UN summit on Climate Change here Ramesh said: "We have been talking with Brazil and South Africa, China not a question of India moving or India accepting, we are doing everything in consultation with the basic group."

"We are coordinating with Africa. But obviously this verification issue is one that concerns the basic group the most. Because these are the ones, which are fast, growers and therefore the emitters amongst the developing countries are concerned. India, China, Brazil and South Africa we have a stated position, its there in the BASIC draft," he added.

Ramesh further disclosed "Today this was reiterated to the US chief negotiator and climate change envoy and he expressed support for some of the elements, he disagreed with some of the elements that we have suggested and we are trying to work out a coordinated position. We don't want this to become a make or break issue."

Noting that India should be the world leader for transparency Ramesh said: "We should be the last ones to be worried about transparency. We have one of the most transparent systems in the world, we have the most accountable systems in the world.

Commenting on India- China alliance on climate change Ramesh said

"I think it will be a re-affirmation of the close relationship that India and China have built up over the last four months on climate change.

" I have been to China twice in the last three months. We have a partnership agreement on climate change. In Copenhagen Chinese environment Minister and myself have been meeting almost every two hours. Our delegations are coordinating our positions. We are speaking with one voice," he said.

Ramesh described the conference helped a lot in achieving solidarity between India and China and also between all the countries of the BASIC group.

"I think the big gain as far as this conference is concerned is the solidarity, the remarkable solidarity between India and China and if I might add, amongst India, China Brazil and South Africa the BASIC group," he said. By Ashok Dixit

India says Kyoto climate pact in "intensive care"

Reuter

The Kyoto Protocol which binds nearly 40 rich nations to limit carbon emissions is in "intensive care" and global negotiations to extend the pact have stalled, India's environment minister said on Wednesday.

More than 190 countries are meeting in Copenhagen to agree the outlines of a new global deal to combat climate change, hoping to seal a full treaty next year to succeed the Kyoto Protocol.

Developing countries want rich nations to be held to their Kyoto obligations, and sign up to a second round of tougher commitments from 2013.

But Jairam Ramesh said many developed countries were "vehemently opposing" the protocol and some of them wanted a single new accord obliging all nations to fight global warming.

"The sense we get is that Kyoto is in intensive care if not dead," Ramesh told reporters.

The protocol obliges nearly 40 industrialised nations to limit emissions by at least 5.2 percent below 1990 levels by 2008-12. It does not impose curbs on poorer nations.

Talks on a pact to succeed Kyoto have been sluggish since they started two years ago, largely because rich nations want to merge Kyoto into a single new accord obliging all nations to fight global warming.

Industrialised nations want a single track largely because the United States, the world's second biggest carbon emitter, never ratified Kyoto. They fear signing up for a binding new Kyoto while Washington slips away with a less strict regime.

Ramesh said Danish Environment Minister Connie Hedegaard, host of the Dec 7-18 U.N. talks, had told him that the conference was unlikely to produce a second commitment period for Kyoto Protocol.

"By trying to shake Kyoto, they (rich nations) are trying to shake one of the basic pillars on which the world had resolved to fight climate change," Ramesh said.

Developing economies such as India have virtually ruled out a single legal undertaking, saying the main mandate of global talks on climate change was to agree the extension of Kyoto.

Negotiators have not been able to agree yet on whether to extend Kyoto and add extra national commitments under a separate pact, or end Kyoto and agree one new treaty which specifies actions by most countries.

Ramesh said rejecting Kyoto was not acceptable to developing countries and that it would be "very very detrimental to a consensus approach".

"This would certainly create problems for long-term action goals," he said, adding talks on Kyoto could still be revived with a helping hand from the United States.

"Kyoto needs a number of oxygen cylinders. One of them is in the White House."

(Editing by Dominic Evans)

Krittivas Mukherjee

World leaders address fraught climate summit

Hindustan Times

Persistently deep divisions threatened to scupper a climate change deal in Copenhagen on Wednesday, but Africa offered a glimmer of hope by asking for less money from rich nations.

"I know my proposal today will disappoint those Africans who, from the point of justice, have asked for full compensation of the damage done to our development prospects," said Ethiopian Prime Minister Meles Zenawi on behalf of African nations present in Copenhagen. Addressing the plenary, Zenawi endorsed UN proposals for fast-start aid of $10 billion per year between 2010 and 2012.

He also estimated long-term aid requirements at up to $50 billion per year by 2015 and $100 billion by 2020. "My proposal dramatically scales back our expectation with regards to the level of funding in return for more reliable funding and a seat at the table in the management of such a fund," Zenawi said.

The issue of how much money should be given to poor countries to help them deal with global warming, and who should handle the money, is one of the main stumbling blocs on the way to a deal in Copenhagen. But Wednesday's speeches by world leaders also saw a succession of finger-pointing and desperate pleas ahead of Friday's deadline.

Senegalese President Abdoulaye Wade, for instance, accused rich nations of reneging on their promises, while Bolivian President Evo Morales and his Venezuelan counterpart, Hugo Chavez, accused rich countries of creating a "world imperial dictatorship". The head of the European Union (EU) executive, Jose Manuel Barroso, in turn, recalled the bloc's efforts to cut emissions and provide financial aid to poorer nations, and urged the US and China - which together account for about 40 percent of world emissions - to step up their efforts.

And with the conference highlighting a deep rift between rich and poor nations, hecklers chanting "Social justice now!" disrupted a speech by Australian Environment Minister Penny Wong. Meanwhile, two draft texts prepared by bureaucrats in the run-up to high-level talks had failed to materialise on time, highlighting a lack of consensus among the nearly 200 delegations.

Some, including China and Brazil, also delayed proceedings, accusing the Danish presidency of excluding them from part of the negotiations. "The world is expecting us to move forward and we are talking procedures, procedures, procedures," complained Danish Prime Minister Lars Lokke

"This is not about procedure, this is a matter of substance," retorted China's chief negotiator, Wei Su. Organisers were forced to issue a statement after some media outlets reported that the conference's chairwoman, Connie Hedegaard, had resigned.

Danish officials said they had always planned to entrust Rasmussen with conducting talks with fellow leaders and environment ministers, while Hedegaard was to lead informal consultations during the latter part of the conference. A restricted group of 25 countries, among them Britain, Germany and four other European nations, were discussing ways of helping the conference's chair break the impasse, German Environment Minister Nobert Roettgen explained earlier in the day.

Roettgen said major problems remained between the Danish presidency of the conference and the G77 group of developing nations, which includes big countries like India and China, but also smaller nations from Africa. "We are extremely disappointed at the lack of progress," said a delegate from Tuvalu, whose Pacific island state risks being submerged by rising sea levels as a result of global warming.

"I come here today to make a simple plea to seal the deal which will save my country, my people and our cultural heritage. The survival of my country is in peril," said Micronesian President Emanuel Mori.

The UN talks in Copenhagen aim to keep global warming in check by demanding massive greenhouse gas emission cuts from rich countries and billions of dollars in aid to the developing world. The EU was said to be considering raising its target on emissions cuts from 20 to 25 percent against 1990 levels by 2020 in a bid to encourage other parties to step up their efforts.

Prior to the start of the Copenhagen conference, the EU said it would raise its target to 30 percent, but only if other major polluters came up with comparable offers. The US has so far offered a 17-percent cut against 2005 levels.

An earlier base year would imply deeper cuts. But US negotiators say their longer-term targets are far more ambitious.

UNFCCC, Kyoto Protocol must be strengthened, says Wen

Chinese Premier Wen Jiabao said Friday the United Nations Framework Convention on Climate Change (UNFCCC) and its Kyoto Protocol reflected a broad consensus among all parties and, therefore, it must be further strengthened.

Speaking at the opening session of the final segment of the Copenhagen climate summit here, Wen said the campaign against climate change hasn't just started and the international community has been engaged in this endeavour for decades now, Xinhua reported.

'The UNFCCC and the Kyoto Protocol are the outcomes of long and hard work by all countries' and the two documents reflected the broad consensus among all parties and served as the legal basis and guide for international cooperation on climate change, Wen said.

So the UNFCCC and the Kyoto Protocol 'must be highly valued and further strengthened and developed,' he said.

Wen said the outcome of the Copenhagen conference must stick to, rather than obscure, the basic principles enshrined in the convention and the protocol and it must follow, rather than deviate from, the mandate of the 'Bali Roadmap.'

'It should lock up rather than deny the consensus and progress already achieved in the negotiations,' Wen said, adding a long-term perspective and a focus on the present were needed in tackling climate change.

'In tackling climate change, we need to take a long-term perspective but, more importantly, we should focus on the present. The Kyoto Protocol has clearly set out the emission reduction targets for developed countries in the first commitment period by 2012,' Wen said.

However, a review of implementation showed the emissions from many developed countries had increased rather than decreased and the mid-term reduction targets, announced by developed countries recently, fell considerably short of the UNFCCC requirements and the expectations of the international community, he said.

'It is necessary to set a direction for our long-term efforts, but it is even more important to focus on achieving near-term and mid-term reduction targets, honouring the commitments already made and taking real action,' Wen said.

The Chinese leader said his country's population of 1.3 billion presented a special difficulty in cutting emissions but it would do whatever was within its capacity to address global climate change.

China's per capita GDP has only just exceeded $3,000 and, according to UN standards, it still had 150 million people living below the poverty line and faced the arduous task of developing the economy and improving people's livelihoods, he said.

'China is now at an important stage of accelerated industrialization and urbanization, and, given the predominant role of coal in our energy mix, we are confronted with a special difficulty in emissions reduction,' Wen said.

However, China had always regarded addressing climate change as an important strategic task, he said, adding that, between 1990 and 2005, China's carbon dioxide emissions per unit of GDP were reduced by 46 percent.

'Building on that, we have set the new target of cutting carbon dioxide emissions per unit of GDP by 40-45 percent by 2020 from the 2005 level,' Wen said.

He said China had not attached any condition to its target for mitigating greenhouse gas emissions or linked it to the target of any other country. 'This is a voluntary action China has taken in light of its national circumstances,' Wen said.

'We will honour our word with real action. Whatever outcome this conference may produce, we will be fully committed to achieving and even exceeding the target.'

News from The Globe and Mail

Carbon trading a tug of war

Wall Street wants in but U.S. officials wary

KONRAD YAKABUSKI

00:00 EST Wednesday, December 16, 2009

WASHINGTON -- Wall Street sees carbon trading and related derivative products as the next big thing in financial innovation. Critics say it's the next big financial mess.

Carbon trading provides a way for companies to stimulate green energy and carbon reduction projects by financing them through the purchase of carbon credits.

Such trading has slowed over the past year or so amid uncertainty about regulations and global emissions targets. Eventually, though, many expect carbon trading to balloon into a multitrillion-dollar business.

But some environmentalists and Democratic legislators don't want banks' financial engineering behind the business of combatting global warming.

Allowing derivative traders access to carbon trading risks

sowing the seeds of the next financial cataclysm and might hinder attempts to curb greenhouse gas emissions, they argue.

"From the financial crisis, we know that Wall Street is innovative. The other lesson we learned is that our regulations, no matter how well we try to write them, just can't keep up," said Michelle Chan of the Green Investments Project at Friends of the Earth.

FOE and other environmental groups have been pressing the Senate to pass legislation that puts strict limits on banks' involvement in the carbon-trading business. Meanwhile, the banking industry - the same bankers that President Barack Obama chided this week for lobbying instead of lending - has hired more than 100 lobbyists to work almost exclusively on ensuring their role as central players in the carbon market.

So far, the banks have been losing. Legislation adopted by House of Representatives in June prohibits derivatives based on emissions credits from trading outside formal exchanges, such as the Chicago Climate Exchange.

Such "over-the-counter" derivatives are harder to track and parties to a transaction do not have to post collateral with a clearinghouse to back up their trades. That makes it difficult to assess the level of risk in the overall market - one of the reasons OTC derivatives such as credit default swaps have been fingered for causing the 2008 financial meltdown..

The banking industry had hoped to avoid a prohibition on OTC carbon derivatives in a Senate version of the climate change bill; had it been successful, the House might have been forced to drop its interdiction when the bills from both chambers are merged into one.

Instead, two senators - a Democrat and a Republican - introduced legislation last Friday that would prohibit the emergence of a secondary market in carbon trading and limit participation in the buying and selling of greenhouse gas credits to a few thousand fossil fuel producers and importers.

According to a summary of the bill by Democrat Maria Cantwell of Washington, and Republican Susan Collins of Maine, "no Wall Street traders or speculators [could] manipulate prices or supply" because only firms directly engaged in fossil fuels could bid on credits. That would kill any prospect for all carbon-related derivatives, even those traded on exchanges.

"Requiring all financial transactions to be undertaken on exchanges would render the U.S. carbon market extremely inefficient - which from a financial perspective is defeating the whole purpose of setting up a carbon market in the first place," said Abyd Karmali, global head of carbon markets at Merrill Lynch.

In a telephone interview from Copenhagen, where he is attending the UN climate change summit, Mr. Karmali said financial institutions have a critical role to play in helping companies meet their emissions reduction targets, for example by selling futures contracts that enable firms to lock in the price of carbon months or years in advance.

"Companies generally prefer to do their long-duration hedging on an over-the-counter basis where they get much better pricing," said Mr. Karmali, who is also president of the Carbon Markets and Investors Association.

The Cantwell-Collins bill proposes to auction carbon permits among emitters, with 75 per cent of the proceeds to be returned to taxpayers in the form of a monthly cheque and most of the rest invested in research in green technology.

A Senate bill in the works by Democrat John Kerry, Republican Lindsey Graham and Independent Joe Lieberman would make cap and trade the central mechanism employed to achieve targeted reductions in planet-warming emissions. So far, the trio has been silent on who could participate in an emissions-trading scheme.

Under a pure cap-and-trade model, permits to emit carbon are auctioned and firms that surpass their emissions limit must either slash their output of carbon dioxide or buy additional permits on the open market. Under the House bill, however, all but 15 per cent of initial permits would be handed out for free to large U.S. emitters of greenhouse gases.

Banks are also eyeing the carbon offset business, under which projects that take CO{-2} out of the atmosphere - for example, tree planting in the developing world - are bundled together to create securities sold to investors. Such instruments would be based on the same principle as mortgage-backed securities - but they would be more transparent, Mr. Karmali insisted.

"Every offset is documented in the public domain on the UN website. I don't think there is any other market as transparent as that."

globeinvestor

depended on trade Unions and Never did believe the Imminent Disinvestment and Divestment. Dollars. CARBON Trading is IMMINENT. Technology Transfer and Carbon Trading are going to be the latest game to fatten the Swiss Bank accounts! My wife is an M.A. in Economics and would not understand. My friends at my work place Rasmussen, who took over the chair of the conference.

December 17th, 2009

Report explores trends in software for managing emissions and carbon trading activities

If one of your New Year's resolutions is to figure out which software to use to manage your company's environmental and energy management programs, there is a new report out by research firm UtiliPoint (although it will cost you $1,500 to buy it). The angle that UtiliPoint takes it that there will be two distinct categories that emerge: one to handle carbon activities in much the way that a business would manage other commodities that are vital to its operations, the second for monitoring greenhouse gas emissions. The new research also contains an update of the regulatory environment.

Here's a comment from of the report's authors:

"In undertaking the study, we were particularly interested in the coming clash of the emissions monitoring and missions emissions trading vendors. In reality, while there will need to be integration between the two types of software, we feel that the evidence suggests that the existing CTRM (commodity trading and risk management) vendors will have a relatively easy task of adding GHG (greenhouse gas) trading and risk management functionality in their software and will continue to own that part of the business. As the emissions monitoring side develops and matures, it will naturally leave an area of functionality related to tracking and managing allowances that can be likened to the 'logistical' side of managing carbon."

Heather Clancy is an award-winning business journalist in the New York area with more than 20 years experience covering the high-tech industry. See her full profile and disclosure of her industry affiliations. See her full profile and disclosure of her industry affiliations.

Heather Clancy is an award-winning business journalist in the New York area with more than 20 years experience covering the high-tech industry. See her full profile and disclosure of her industry affiliations. See her full profile and disclosure of her industry affiliations.

Subscribe to GreenTech Pastures via Email alerts or RSS.

http://blogs.zdnet.com/green/?p=9377

| India flexible, US dangles dollars 75% deal on norms to verify emission cuts | |

| JAYANTA BASU | |

Copenhagen, Dec. 17: India has shown a sign of accommodation at the climate change summit here, indicating it is ready to discuss international scrutiny of its domestic actions to curb greenhouse emissions. Delhi's negotiating manoeuvre may have helped secure a gift from America to developing countries — an announcement this morning by secretary of state Hillary Clinton that the US would work with other nations to create by 2020 a $100-billion-a-year fund to help the developing countries deal with climate change. India has consistently asserted that it would open only emission-curbing actions supported by foreign finance to international scrutiny — a process known as monitoring review and verification (MRV). Both India and China have been under pressure from the European Union and the US to allow MRV on all emission-curbing actions. Environment minister Jairam Ramesh, who had indicated the need for the country to be "flexible", today said India had agreed to three-fourths of the issues involving verification. "We had a meeting with the Americans this morning and had 75 per cent agreement on verification — 25 per cent remain," Ramesh said. "The modus operandi of reporting of domestic actions to international agencies such as a UN climate change agency remains a sore point," a source said. While India is prepared to give some information, Americans want more. "We don't want MRV to become a make-or-break issue — there are other important issues like Kyoto (Protocol) and the long-term co-operation that need to be sorted out," the minister said. "I said in Parliament we need to be flexible. Anyway, India is one of the most transparent countries in the world and we have nothing to hide." CPM leader Sitaram Yechury, who is part of the Indian delegation at the climate summit, said if India agreed to the provisions of MRV for domestic action, the issue would be raised in Parliament. Ramesh's announcement came after Clinton made a veiled threat in Copenhagen that unless China and India took on emission curbs and opened themselves to international monitoring of their emission curbs, no US financial deal would be possible. Clinton said the US would help raise funds as long as China and India accepted binding commitments that they were open to international inspection and verification. "In the absence of an operational agreement that meets the requirements that I outlined, there will not be that financial agreement, at least from the US," Clinton said, reflecting the Obama administration's domestic compulsions. Unless the Obama administration can convince politicians back home that China and India have made some concessions, emission controls in the US would be impossible to push through. Clinton said the US expected transparency in actions aimed at curbing emissions. Prime Minister Manmohan Singh, who reached Copenhagen today, said in a statement before leaving Delhi: "We are willing to do more (to reduce emissions) provided there are credible arrangements to provide additional financial support (and) technological transfers from the developed to the developing countries." Ramesh said two draft texts released by two groups of negotiators at the climate summit would form the core of the political draft that is expected to emerge from the summit. A key contentious issue in the talks has been whether to continue with the 12-year old Kyoto Protocol which imposes legally binding emissions reductions on the rich countries. Developing countries want industrialised countries to take on deep emissions reductions in the second phase of the Kyoto Protocol -- 2013 onwards. But several industrialised countries are unhappy that the US and China which make up 50 per cent of the world's emissions are not part of the Kyoto Protocol. They want a new pact with both US and China onboard. Clinton, while announcing the $100 billion pledge, said the US expected transparency in actions aimed at curbing emissions. "If there is not even a commitment to pursue transparency, that's kind of a dealbreaker for us," Clinton said. "All the major economies have committed to transparency. Now that we're trying to define what transparency means and how we would both implement it and observe it, there is a backing away from transparency," she said. Non-government conference observers have welcomed the US pledge, but said the source of the funding and the contribution from the US itself still remains unclear. "Financing was one of the missing pieces in Copenhagen," said Jennifer Morgan, a senior analyst with the World Resources Institute in the US. "This is a solid first step. But the world will need further clarification on the specifics, particularly whether this money will be additional to current funding," Morgan said. |

http://www.telegraphindia.com/1091218/jsp/frontpage/story_11881078.jsp

Friday December 18, 2009

FACTBOX - Comparison of U.S. plans to cap carbon

REUTERS - A "cap and dividend" bill introduced in the U.S. Senate last week would reduce the role of Wall Street in carbon markets by returning money raised from emissions credit auctions to the public.

It stands in contrast to the climate bill stalled in the Senate that would likely have a "cap and trade" market at its heart more open to trading of emissions permits by companies and investors.

|

Steam and other emissions are seen coming from funnels at a chemical manufacturing facility in Melbourne in this June 24, 2009 file photo. (REUTERS/Mick Tsikas/Files) |

Senate Majority Leader Harry Reid hopes climate legislation could be taken up by the full Senate in early spring.

Below are some of the differences between the two market plans. Cap and trade is represented as "C&T" while the other is "C&D".

STATUS OF THE BILLS

* A climate bill with C&T passed narrowly in the House of Representatives in June, known as Waxman-Markey after its sponsors. In the Senate, Democrat John Kerry, Republican Lindsey Graham, and independent Joe Lieberman, are working on compromise legislation that builds on the House bill, but they have not decided on they method to price carbon. They are casting the bill as one that would create jobs

* The C&D bill was introduced last week by Senators Maria Cantwell, a Democrat, and Susan Collins, a Republican. It comes late in the game as many lawmakers are already committed to C&T. It would also have to be passed in the House.

KEY SUPPORTERS

* The Obama administration, many Democrats in Congress and major environmental groups support C&T, saying it is the most efficient way to cut emissions.

* The C&D bill has not been out long enough to garner as much attention.

HOW THE BILLS ARE BEING TOUTED - JOBS AND CHECKS

* Kerry, Graham and Lieberman are touting the compromise bill, which would likely contain C&T, as legislation that will add jobs in clean energy like nuclear and solar and wind power.

* C&D would result in tax-free monthly checks sent to every American and averaging $1,100 a year for a family of four.

RISKS

* C&T opponents do not want Washington to establish what could become a trillion-dollar carbon market after recent massive mismanagement in the banking industry and lack of government oversight.

* C&D opponents say the system does not give companies enough flexibility to convert to renewable energy like wind and solar or buy offsets.

COMPLEXITY OF THE BILLS

* C&T bill, known as Kerry-Boxer in the Senate, is over 1,000 pages.

* C&D came in at under 40 pages.

TARGETS OF THE 2 PLANS

* C&T targets big polluters, such as power plants, oil refineries, and makers of glass, cement and chemicals. Transportation sources would also be targeted.

* C&D only targets producers and importers of fossil fuels such as coal mining companies and oil importers.

HOW THEY WOULD WORK

* C&T would initially auction 25 percent of the permits to pollute and distribute the rest of the permits to polluters. The proceeds would go to state regulators to invest in cutting power bills or to develop energy efficiency programs.

Companies and investors would be allowed to sell the permits in a market to polluters that need the credits to meet an ever-declining emissions cap. The market gives companies the option of cutting their own output of greenhouse gases or buying credits representing emissions cuts.

* C&D would institute monthly auctions in which companies covered by the legislation would have to buy permits to pollute. Most of the proceeds would go to the public, while 25 percent would go to the development of clean energy.

EMISSIONS TARGETS

* C&T backers are focusing on a 17 percent cut by 2020 under 2005 levels, with much stronger cuts by 2050.

* C&D backers want a reduction of 20 percent by 2020 under 2005 levels and stronger cuts by 2050.

(Reporting by Timothy Gardner; Editing by David Gregorio)

Copyright © 2008 Reuters

Ads by Google

Cop 15 in CopenhagenSiemens answers the world's toughest questions.www.siemens.com/answersSave your environment nowJoin an environment and climate communitywww.worldclimatecommunity.com

Green Karma360 Degree Carbon Solutions Consultants for CDM/VER Projectswww.gensolconsultants.com

http://thestar.com.my/news/story.asp?file=/2009/12/18/worldupdates/2009-12-18T080351Z_01_NOOTR_RTRMDNC_0_-448252-1&sec=Worldupdates

- Dec. 17 (Bloomberg) -- Three U.S. airlines and the Air Transport Association sued the U.K. government to challenge the first stage of the country's implementation of European Union emission-trading regulations.Bloomberg - 18 Dec 12:19AM

- Calgon Carbon said today it has won a $14.3 million contract to provide granular activated carbon for two drinking water treatment plans in Phoenix.Pittsburgh Post-Gazette - 17 Dec 11:44PM

- B.C.'s Haida First Nation hopes to set aside one quarter of its forested land mass to attract millions of dollars in the growing carbon trading market.CBC via Yahoo! Canada News - 16 Dec 04:55PM

- REGINA, SK--(Marketwire - December 17, 2009) - HTC Purenergy Inc. ("HTC") ( TSX-V : HTC ) is pleased to announce today it will acquire a majority interest in Carbon Capital Management Inc. ("CCM") -- a Canadian-based and privately held company. CCM, wholly owned by Front Street Capital 2004, created the leading carbon offset origination firm in Canada over the past two years. CCM will continue ...Marketwire - 18 Dec 01:23AM

- Sam Laidlaw, chief executive of UK energy firm Centrica, says energy efficiency alone is not enough to meet emission cut targets, so low carbon energy sources must be developed.BBC News - 17 Dec 04:57AM

- Standard Bank and China's Guodian Power have signed a carbon emission reductions purchase agreement.Independent Online - 17 Dec 08:05PM

- THE Liberal Party has assured the Nationals that the Coalition's greenhouse gas reduction policy would involve planting trees almost entirely on marginal land, not good farm land.Brisbane Times - 2 hours, 10 minutes ago

- Johannesburg — IF SA is to realise its commitment to cut its carbon footprint, as it has promised at the climate talks in Copenhagen, South African companies will have to do more to curb their emissions.AllAfrica.com - 17 Dec 02:45PM

- With Copenhagen climate talks looking stalled and the Senate mired in complicated eco-wrangling, is there a simpler way to get the U.S. to reduce the carbon emissions that most scientists blame for global warming?CNNMoney.com via Yahoo! Finance - 17 Dec 12:54AM

- Standard Bank will buy carbon emissions produced by China's Guodian Power.iafrica.com - 17 Dec 02:44PM

- A deal on carbon pricing at the Copenhagen summit looks increasingly unlikely, according to Simon Webber, co-manager of Schroders Global Climate Change fund.eFinancial News - 17 Dec 07:02PM

- One of the major issues facing delegates working on a new international climate change treaty at COP15 is how we can improve carbon offset trading programs, both in reference to the current Clean Development Mechanism (CDM) protocols and proposed protocols such as those for Reducing Emissions from Deforestation and Degradation (REDD).GreenBiz - 18 Dec 01:16AM

- The clean-coal industry has been shut out of the global emissions trading scheme at the Copenhagen climate change talks, dealing a blow to the UK, US and Australia.Daily Telegraph - 17 Dec 12:01AM

- LONDON - Dwindling prospects a strong climate deal at a U.N. summit in Copenhagen were likely to knock carbon permits under the European Union emissions trading scheme, traders said, and prices fell to a two-week low on Thursday.Planet Ark - 18 Dec 04:04AM

- A CENTRAL element of Tony Abbott's alternative plan to cut greenhouse gases has hit a hurdle, with the National Party warning against the mass planting of trees.Queensland Country Life - 18 Dec 02:17AM

- Rachael Singh, Accountancy Age , Tuesday 15 December 2009 at 10:00:00 The Copenhagen Climate Change Summit sees increased support for a carbon tax or carbon trading scheme for the aviation and shipping industries Support for a global carbon tax or carbon trading scheme for the aviation and shipping industry is gaining widespread support at Copenhagen. If an agreement is reached the money ...vnunet.com - 15 Dec 03:42PM

- On the eve of President Obama's appearance at the U.N. climate talks in Copenhagen, congressional Republicans said they would file a resolution aimed at overturning an EPA finding that underpins the administration's pledge to cut U.S. carbon emissions.CQPolitics.com via Yahoo! News - 18 Dec 02:13AM

- Wall Street wants in but U.S. officials waryThe Globe and Mail - 16 Dec 02:25PM

- Dec 17 (Reuters) - Banks are boosting their commodities staff to take advantage of the upswing in prices this year and greater risk appetite among investors.Reuters via Yahoo! Singapore News - 17 Dec 10:17PM

Acupuncture Needle Acupuncture Needles Acupuncture Acupuncture ...

Carbo Trading Co Inc. - Acupuncture & Medical Supplies, Clinical ...

Carbo Trading Co. Inc. Is a manufacturer / wholesaler for well known brand CARBO acupuncture needle, with its modern factory and quality oriented management ...

www.alibaba.com/member/carbotcm.html - Cached - Similar -Carbo Trading Co Inc.

Carbo Trading Co. Inc. a well-established company since 1992, is the importer and distributor for the well known Carbo MicroCleanTM and AcuMasterTM ...

www.shopintoronto.com/Carbo-Trading-Co-Inc-/332177.htm - Cached -Carbo Trading Company Inc - Artists' Materials & Supplies in ...

Carbo Trading Company Inc - Artists' Materials & Supplies in Scarborough Ontario - Gold Book.

www.goldbook.ca/toronto/Artists-Materials.../1679262.html - Cached -Carbo Trading Co Jobs | Indeed.com

Job search for Carbo Trading Co Jobs at indeed.com. one search. all jobs.

ca.indeed.com/Carbo-Trading-Co-jobs - Canada - Cached -- [PDF]

CARBO TRADING CO. INC. www.carbo.ca CARBO RETURN MERCHANDISE ...

File Format: PDF/Adobe Acrobat - Quick View

CARBO TRADING CO. INC. 4500 SHEPPARD AVENUE EAST, UNIT 1. SCARBOROUGH, ON. M1S 3R6. Tel: (416) 299-6643 Fax: (416) 299-7003 Toll Free Tel: 1-800-370-9077 ...

www.carbo.ca/store/.../Return%20Authorization%20Form.pdf - Similar - Carbo Trading Co, Scarborough, ON on Profile Canada Business ...

Complete address, phone and fax information for Carbo Trading Co. Also see map, employee and sales information, plus products and services offered.

www.profilecanada.com/companydetail.cfm?...Carbo_Trading...Scarborough... - Canada - Cached -Carbo Trading Inc - 4500 Sheppard Avenue East, Scarborough, ON ...

Carbo Trading Inc - 4500 Sheppard Avenue East, Scarborough, ON - 416-299-6643. Acupuncturists Equipment & Supplies.

www.yellowpages.ca/.../Scarborough/Carbo-Trading.../2731466.html - Cached - Similar -- [PDF]

Carbo Trading Co. Inc.

File Format: PDF/Adobe Acrobat - Quick View

Carbo Trading Company, Incorporated. 4500 Sheppard Avenue East, Unit #1. Scarborough, Ontario M 1 S 3R6. CANADA. Re: KO30190 ...

www.accessdata.fda.gov/cdrh_docs/pdf3/k030190.pdf - Similar - Industrial warehouse person, Scarborough, Ontario, Carbo Trading ...

9 Dec 2009 ... Carbo Trading Co. Inc. is looking for an Industrial warehouse person in Scarborough, Ontario.

ontario.jobs-open.ca/.../on-scarborough-ontario-carbo-trading-co-c-industrial-warehouse-person-3mlcc.php - Cached -

Emissions trading

From Wikipedia, the free encyclopedia

Emissions trading (also known as cap and trade) is an administrative approach used to control pollution by providing economic incentives for achieving reductions in the emissions of pollutants.

A central authority (usually a governmental body) sets a limit or cap on the amount of a pollutant that can be emitted. Companies or other groups are issued emission permits and are required to hold an equivalent number of allowances (or credits) which represent the right to emit a specific amount. The total amount of allowances and credits cannot exceed the cap, limiting total emissions to that level. Companies that need to increase their emission allowance must buy credits from those who pollute less. The transfer of allowances is referred to as a trade. In effect, the buyer is paying a charge for polluting, while the seller is being rewarded for having reduced emissions by more than was needed. Thus, in theory, those who can reduce emissions most cheaply will do so, achieving the pollution reduction at the lowest cost to society.[1]

There are active trading programs in several air pollutants. For greenhouse gases the largest is the European Union Emission Trading Scheme.[2] In the United States there is a national market to reduce acid rain and several regional markets in nitrogen oxides.[3] Markets for other pollutants tend to be smaller and more localized.

[edit] Overview

The overall goal of an emissions trading plan is to minimize the cost of meeting a set emissions target.[4] The cap is an enforceable limit on emissions that is usually lowered over time — aiming towards a national emissions reduction target.[4] In other systems a portion of all traded credits must be retired, causing a net reduction in emissions each time a trade occurs. In many cap-and-trade systems, organizations which do not pollute may also participate, thus environmental groups can purchase and retire allowances or credits and hence drive up the price of the remainder according to the law of demand.[5] Corporations can also prematurely retire allowances by donating them to a nonprofit entity and then be eligible for a tax deduction.

Because emissions trading uses markets to address pollution, it is often touted[who?] as an example of free market environmentalism. However, emissions trading requires a cap to effectively reduce emissions, and the cap is a government regulatory mechanism. After a cap has been set by a government political process, individual companies are free to choose how or if they will reduce their emissions. Failure to reduce emissions is often punishable by a further government regulatory mechanism, a fine that increases costs of production. In theory, firms will choose the least-costly way to comply with the pollution regulation, which will lead to reductions where the least expensive solutions exist, while allowing emissions that are more expensive to reduce.

[edit] History

The efficiency of what later was to be called the "cap-and-trade" approach to air pollution abatement was first demonstrated in a series of micro-economic computer simulation studies between 1967 and 1970 for the National Air Pollution Control Administration (predecessor to the United States Environmental Protection Agency's Office of Air and Radiation) by Ellison Burton and William Sanjour. These studies used mathematical models of several cities and their emission sources in order to compare the cost and effectiveness of various control strategies.[6][7][8][9][10] Each abatement strategy was compared with the "least cost solution" produced by a computer optimization program to identify the least costly combination of source reductions in order to achieve a given abatement goal.[11] In each case it was found that the least cost solution was dramatically less costly than the same amount of pollution reduction produced by any conventional abatement strategy.[12] This led to the concept of "cap and trade" as a means of achieving the "least cost solution" for a given level of abatement.

The development of emissions trading over the course of its history can be divided into four phases:[13]

- Gestation: Theoretical articulation of the instrument (by Coase,[14] Crocker,[15] Dales,[16] Montgomery[17] etc.) and, independent of the former, tinkering with "flexible regulation" at the US Environmental Protection Agency.

- Proof of Principle: First developments towards trading of emission certificates based on the "offset-mechanism" taken up in Clean Air Act in 1977.

- Prototype: Launching of a first "cap-and-trade" system as part of the US Acid Rain Program, officially announced as a paradigm shift in environmental policy, as prepared by "Project 88", a network-building effort to bring together environmental and industrial interests in the US.

- Regime formation: branching out from the US clean air policy to global climate policy, and from there to the European Union, along with the expectation of an emerging global carbon market and the formation of the "carbon industry".

[edit] Cap and trade versus offsets created through a baseline and credit approach

The textbook emissions trading program can be called a "cap-and-trade" approach in which an aggregate cap on all sources is established and these sources are then allowed to trade amongst themselves to determine which sources actually emit the total pollution load. An alternative approach with important differences is a baseline and credit program.[18] In a baseline and credit program polluters that are not under an aggregate cap can create credits, usually called offsets, by reducing their emissions below a baseline level of emissions. Such credits can be purchased by polluters that do have a regulatory limit.[19]

[edit] Economics of international emissions trading

It is possible for a country to reduce emissions using a Command-Control approach, such as regulation, direct and indirect taxes. The cost of that approach differs between countries because the Marginal Abatement Cost (MAC) — the cost of eliminating an additional unit of pollution — differs by country. It might cost China $2 to eliminate a ton of CO2, but it would probably cost Sweden or the U.S. much more. International emissions-trading markets were created precisely to exploit differing MACs.

[edit] Example

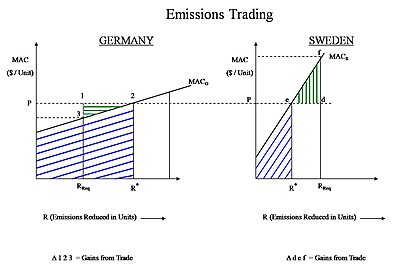

Emissions trading through Gains from Trade can be more beneficial for both the buyer and the seller than a simple emissions capping scheme.

Consider two European countries, such as Germany and Sweden. Each can either reduce all the required amount of emissions by itself or it can choose to buy or sell in the market.

For this example let us assume that Germany can abate its CO2 at a much cheaper cost than Sweden, e.g. MACS > MACG where the MAC curve of Sweden is steeper (higher slope) than that of Germany, and RReq is the total amount of emissions that need to be reduced by a country.

On the left side of the graph is the MAC curve for Germany. RReq is the amount of required reductions for Germany, but at RReq the MACG curve has not intersected the market allowance price of CO2 (market allowance price = P = λ). Thus, given the market price of CO2 allowances, Germany has potential to profit if it abates more emissions than required.

On the right side is the MAC curve for Sweden. RReq is the amount of required reductions for Sweden, but the MACS curve already intersects the market price of CO2 allowances before RReq has been reached. Thus, given the market allowance price of CO2, Sweden has potential to make a cost saving if it abates fewer emissions than required internally, and instead abates them elsewhere.

In this example, Sweden would abate emissions until its MACS intersects with P (at R*), but this would only reduce a fraction of Sweden's total required abatement. After that it could buy emissions credits from Germany for the price P (per unit). The internal cost of Sweden's own abatement, combined with the credits it buys in the market from Germany, adds up to the total required reductions (RReq) for Sweden. Thus Sweden can make a saving from buying credits in the market (Δ d-e-f). This represents the "Gains from Trade", the amount of additional expense that Sweden would otherwise have to spend if it abated all of its required emissions by itself without trading.

Germany made a profit on its additional emissions abatement, above what was required: it met the regulations by abating all of the emissions that was required of it (RReq). Additionally, Germany sold its surplus to Sweden as credits, and was paid P for every unit it abated, while spending less than P. Its total revenue is the area of the graph (RReq 1 2 R*), its total abatement cost is area (RReq 3 2 R*), and so its net benefit from selling emission credits is the area (Δ 1-2-3) i.e. Gains from Trade

The two R* (on both graphs) represent the efficient allocations that arise from trading.

- Germany: sold (R* - RReq) emission credits to Sweden at a unit price P.

- Sweden bought emission credits from Germany at a unit price P.

If the total cost for reducing a particular amount of emissions in the Command Control scenario is called X, then to reduce the same amount of combined pollution in Sweden and Germany, the total abatement cost would be less in the Emissions Trading scenario i.e. (X — Δ 123 - Δ def).

The example above applies not just at the national level: it applies just as well between two companies in different countries, or between two subsidiaries within the same company.

[edit] Applying the economic theory

The nature of the pollutant plays a very important role when policy-makers decide which framework should be used to control pollution.

CO2 acts globally, thus its impact on the environment is generally similar wherever in the globe it is released. So the location of the originator of the emissions does not really matter from an environmental standpoint.

The policy framework should be different for regional pollutants[20] (e.g. SO2 and NOX, and also mercury) because the impact exerted by these pollutants may not be the same in all locations. The same amount of a regional pollutant can exert a very high impact in some locations and a low impact in other locations, so it does actually matter where the pollutant is released. This is known as the Hot Spot problem.

A Lagrange framework is commonly used to determine the least cost of achieving an objective, in this case the total reduction in emissions required in a year. In some cases it is possible to use the Lagrange optimization framework to determine the required reductions for each country (based on their MAC) so that the total cost of reduction is minimized. In such a scenario, the Lagrange multiplier represents the market allowance price (P) of a pollutant, such as the current market allowance price of emissions in Europe[21] and the USA.[22]

All countries face the market allowance price that exists in the market that day, so they are able to make individual decisions that would minimize their costs while at the same time achieving regulatory compliance. This is also another version of the Equi-Marginal Principle, commonly used in economics to choose the most economically efficient decision.

[edit] Prices versus quantities, and the safety valve

There has been longstanding debate on the relative merits of price versus quantity instruments to achieve emission reductions.[23]

An emission cap and permit trading system is a quantity instrument because it fixes the overall emission level (quantity) and allows the price to vary. Uncertainty in future supply and demand conditions (market volatility) coupled with a fixed number of pollution credits creates an uncertainty in the future price of pollution credits, and the industry must accordingly bear the cost of adapting to these volatile market conditions. The burden of a volatile market thus lies with the industry rather than the controlling agency, which is generally more efficient. However, under volatile market conditions, the ability of the controlling agency to alter the caps will translate into an ability to pick "winners and losers" and thus presents an opportunity for corruption.

In contrast, an emission tax is a price instrument because it fixes the price while the emission level is allowed to vary according to economic activity. A major drawback of an emission tax is that the environmental outcome (e.g. a limit on the amount of emissions) is not guaranteed. On one hand, a tax will remove capital from the industry, suppressing possibly useful economic activity, but conversely, the polluter will not need to hedge as much against future uncertainty since the amount of tax will track with profits. The burden of a volatile market will be borne by the controlling (taxing) agency rather than the industry itself, which is generally less efficient. An advantage is that, given a uniform tax rate and a volatile market, the taxing entity will not be in a position to pick "winners and losers" and the opportunity for corruption will be less.

Assuming no corruption and assuming that the controlling agency and the industry are equally efficient at adapting to volatile market conditions, the best choice depends on the sensitivity of the costs of emission reduction, compared to the sensitivity of the benefits (i.e., climate damages avoided by a reduction) when the level of emission control is varied.

Because there is high uncertainty in the compliance costs of firms, some argue that the optimum choice is the price mechanism. However, the burden of uncertainty cannot be eliminated, and in this case it is shifted to the taxing agency itself.

Some scientists have warned of a threshold in atmospheric concentrations of carbon dioxide beyond which a run-away warming effect could take place, with a large possibility of causing irreversible damages. If this is a conceivable risk then a quantity instrument could be a better choice because the quantity of emissions may be capped with a higher degree of certainty. However, this may not be true if this risk exists but cannot be attached to a known level of GHG concentration or a known emission pathway.[24]

A third option, known as a safety valve, is a hybrid of the price and quantity instruments. The system is essentially an emission cap and permit trading system but the maximum (or minimum) permit price is capped. Emitters have the choice of either obtaining permits in the marketplace or purchasing them from the government at a specified trigger price (which could be adjusted over time). The system is sometimes recommended as a way of overcoming the fundamental disadvantages of both systems by giving governments the flexibility to adjust the system as new information comes to light. It can be shown that by setting the trigger price high enough, or the number of permits low enough, the safety valve can be used to mimic either a pure quantity or pure price mechanism.[25]

All three methods are being used as policy instruments to control greenhouse gas emissions: the EU-ETS is a quantity system using the cap and trading system to meet targets set by National Allocation Plans, the UK's Climate Change Levy is a price system using a direct carbon tax, while China uses the CO2 market price for funding of its Clean Development Mechanism projects, but imposes a safety valve of a minimum price per tonne of CO2.

[edit] Incomplete country cooperation and border adjustments