IMF Brigade and rating agencies run through Indian economy!US ready to work with Narendra Modi, visa not an issue: US Official

Finance Minister P Chidambaram to address industry bodies on service tax amnesty scheme

M Veerappa Moily asks Finance Ministry to cut duties on branded petrol, diesel

Palash Biswas

The guidelines, a step toward opening up India's long-protected banking sector, allow the banks to capitalize on the country's huge, barely tapped market and be treated nearly the same as local banks.

Nuclear-capable Agni-I ballistic missile successfully test-fired

India today successfully test-fired its indigenously developed nuclear-capable Agni-I ballistic missile with a strike range of 700 km

BALASORE: India today successfully test-fired its indigenously developed nuclear-capable Agni-I ballistic missile with a strike range of 700 km from a test range off Odishacoast as part of a user trial by the Army.

The surface-to-surface, single-stage missile, powered by solid propellants, was test-fired from a mobile launcher at 0933 hrs from launch pad-4 of the Integrated Test Range at Wheeler Island, about 100 km from here.

"The test-fire of the ballistic missile was fully successful," ITR Director M V K V Prasad said.

"Agni-I missile was launched by the Strategic Forces Command ( SFC)," he said, adding the DRDO developed medium-range ballistic missile from the production lot was launched as part of regular training exercise by the armed forces.

The Agni-I missile has a specialised navigation system which ensures it reaches the target with a high degree of accuracy and precision, he said.

Weighing 12 tonnes, the 15-metre-long Agni-I, which can carry payloads up to 1000 kg, has already been inducted into the Indian Army.

Agni-I was developed by advanced systems laboratory, the premier missile development laboratory of the DRDO in collaboration with Defence Research Development Laboratoryand Research Centre Imarat and integrated by Bharat Dynamics Limited, Hyderabad.

The last trial of the sophisticated Agni-I missile was successfully carried out on December 12, 2012 from the same base.

M Veerappa Moily asks Finance Ministry to cut duties on branded petrol, diesel!Tax forgone is not an affair all about budget making.It is sustained phenomenon of Indian economy which overloades taxation against the toiling margines and forgoes everything taxable in the best interest of the black moey monopolistic corporate class. Oil Minister M Veerappa Moilyhas asked the Finance Ministry to cut duties on branded petrol and diesel that offer better mileage and help cut fuel consumption.

Best joke,though, comes from the WTO kitty of Mr. kamalnath. The corporate minister of global world order cries foul against Goldman Sach,the rating agency, having confessed criminal conduct,posted lotus on India map.Kamalnath has no trouble with Goldman Sach as the ruling hegemony is quite habitual in bed with the hot red chillies,the rating agencies which dictate growth terms and conditions of growth and development,policy making in India.

Meanwhile,the ruling hegemony inducted yet another IMF man to boost the trickling economy of ethnic cleansing.

On the other hand, aiming to garner higher revenue from indirect taxes, Finance Minister P Chidambaram will address industry bodies at Chennai, Delhi and Mumbai on Voluntary Compliance Encouragement Scheme 2013.

Moreover,currently, the Finance Ministry levies higherexcise duty on premium or branded petrol and diesel, making them costlier than normal or unbranded auto fuel.

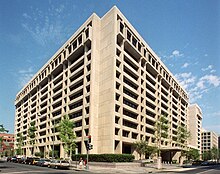

At a Glance - India and the IMF

India joined the IMF on December 27, 1945, as one of the IMF's original members.

-

For India's Governor, quota, and voting power in the IMF, see www.imf.org/external/np/sec/memdir/members.htm

For India's Executive Director in the IMF and constituency, see www.imf.org/external/np/sec/memdir/eds.htm

India accepted the obligations of Article VIII Article VIII of the IMF Articles of Agreement on current account convertibility on August 20, 1994.

India subscribes to the IMF's Special Data Dissemination Standard. Countries belonging to this group make a commitment to observe the standard and to provide information about their data and data dissemination practices.

Financial Assistance

While India has not been a frequent user of IMF resources, IMF credit has been instrumental in helping India respond to emerging balance of payments problems on two occasions. In 1981-82, India borrowed SDR 3.9 billion under an Extended Fund Facility, the largest arrangement in IMF history at the time. In 1991-93, India borrowed a total of SDR 2.2 billion under two stand by arrangements, and in 1991 it borrowed SDR 1.4 billion under the Compensatory Financing Facility. Further information on India's financial position in the Fund, see http://www.imf.org/external/

np/tre/tad/exfin2.cfm?memberKey1=430

Technical Assistance

In recent years, the Fund has provided India with technical assistance in a number of areas, including the development of the government securities market, foreign exchange market reform, public expenditure management, tax and customs administration, and strengthening statistical systems in connection with the Special Data Dissemination Standards. Since 1981 the IMF Institute has provided training to Indian officials in national accounts, tax administration, balance of payments compilation, monetary policy, and other areas.

http://www.imf.org/external/country/ind/rr/glance.htm

India and the IMF - The Hindu

Oct 20, 2013 - In specific focus has been the sharp downgrade by the IMF of India'sgrowth forecast for 2013-14. In its latest update to the World Economic ...

Chidambaram publicly questions IMF's growth projection for India ...

Oct 13, 2013 - Publicly questioning the methodology adopted by the International Monetary Fund (IMF) for its growth projections for India, Finance Minister P.

Rangarajan rejects IMF, WB forecasts, predicts 5% GDP growth ...

Oct 24, 2013 - The IMF, in its World Economic Outlook, projected an average growth rate of about 3.75 per cent, based on market prices, for India in 2013-14, ...

After IMF, World Bank now cuts India GDP growth forecast to 4.7 per ...

www.financialexpress.com/news/after-imf-world...india.../1183375

Oct 16, 2013 - The report - India Development Update - expects India's GDP to accelerating to 6.2% in FY2015.

IMF team coming to check India's economic health in Nov | Business ...

www.business-standard.com/.../imf-team-coming-to-check-india-s-econo...

Oct 26, 2013 - Part of periodic Article IV consultations on state of the economy; team to have discussions with government as well as banks, private investors ...

IMF, WB unduly pessimistic on India: C Rangarajan | Business ...

www.business-standard.com/.../imf-wb-unduly-pessimistic-on-india-c-ra...

Oct 25, 2013 - Earlier this month, World Bank slashed India's economic growth forecast for the current financial year to 4.7% from an earlier projection of 5.7%

Indian growth to shrink to 3.8%: IMF - The Times of India

Oct 8, 2013 - India's economic growth rate will shrink to 3.8% this year as the corruption-hit government struggles to restore investor confidence ahead of ...

Roots of the 'IMF riots'

October 01, 2012

Throughout the 1980s and 90s, when many developing countries were in crisis and borrowing money from the International Monetary Fund (IMF), waves of protests in those countries became known as the "IMF riots". They were so called because they were sparked by the fund's structural adjustment

programmes, which imposed austerity, privatisation and deregulation.

The IMF complained that calling these riots thus was unfair, as it had not caused the crises and was only prescribing a medicine, but this was largely self-serving. Many of the crises had actually been caused by the asset bubbles built up following IMF-recommended financial deregulation.

Moreover, those rioters were not just expressing general discontent but reacting against the austerity measures that directly threatened their livelihoods, such as cuts in subsidies to basic commodities such as food and water, and cuts in already meagre welfare payments.

The IMF programme, in other words, met such resistance because its designers had forgotten that behind the numbers they were crunching were real people. These criticisms, as well as the ineffectiveness of its economic programme, became so damaging that the IMF has made a lot of changes in the past decade or so. It has become more cautious in pushing for financial deregulation and austerity programmes, renamed its structural adjustment programmes as poverty reduction programmes, and has even (marginally) increased the voting shares of the developing countries in its decision-making.

Given these recent changes in the IMF, it is ironic to see the European governments inflicting an old-IMF-style programme on their own populations. It is one thing to tell the citizens of some faraway country to go to hell but it is another to do the same to your own citizens, who are supposedly your ultimate sovereigns. Indeed, the European governments are out-IMF-ing the IMF in its austerity drive so much that now the fund itself frequently issues the warning that Europe is going too far, too fast.

The threat to livelihoods has reached such a dimension that renewed bouts of rioting are now rocking Greece, Spain and now Portugal. In the case of Spain, its national integrity is threatened by the separatist demand made by the Catalan nationalists, who think the austerity policy is unfairly reducing the region's autonomy.

What has been happening in Europe — and indeed the US in a more muted and dispersed form is nothing short of a complete rewriting of the implicit social contracts that have existed since the end of the World War 2. In these contracts, renewed legitimacy was bestowed on the capitalist system, once totally discredited following the great depression. In return, it provided a welfare state that guarantees minimum provision for all those burdens that most citizens have to contend with throughout their lives — childcare, education, health, unemployment, disability and old age.

European democracies are not just threatening the livelihoods of so many people and pushing the economy into a downward spiral, but are also undermining the legitimacy of the political system through the backdoor rewriting of the social contract. Especially if they are going to have to go through long tunnels of economic difficulties in coming years, and that in the context of global shifts in economic power balance and of severe environmental challenges, European countries can ill-afford to have the legitimacy of their political systems damaged in this way.

The Guardian

Jairam Ramesh,the human face of the ethnic cleansing guillotine,is not far behind the mega salesman.The government stepped up its criticism of leading opposition prime-ministerial candidate Narendra Modi on Tuesday, painting him as a dangerous extremist and comparing his rise to the birth of Nazi Germany in the 1930s.

Guillotine

The guillotine is a device designed for carrying out executions by decapitation. It consists of a tall upright frame in which a weighted and angled blade is raised to the top and suspended. Wikipedia

Modi's critics have long sought to associate the Hindu nationalist leader with fascism and blame him for anti-Muslim riots in 2002 that killed at least 1,000 people. He denies any wrongdoing in the riots and a Supreme Court investigation found no evidence to prosecute him.

The broadsides from two senior ministers follow a series of large political rallies by Modi and a string of opinion polls forecasting a poor performance by the government in state elections starting next week and a general election expected by April.

The ruling Congress party's own campaign has yet to pick up much steam.

Jairam Ramesh, a senior cabinet minister close to the leadership of the Congress party, said Modi's career reminded him of the rise of the Third Reich, the strongest comments yet by a minister of his rank.

"Political autocracy, social divisiveness and economic liberalism. That's Mr. Modi reduced to three dimensions," Ramesh told Reuters. "Exactly what created the autobahns and the Volkswagens in the 30s but also created the disaster of Germany.

"India right now in 2013 - I would say we are going through what Germany went through in 1932."

Modi's Bharatiya Janata Party, which ruled with a moderate prime minister between 1998 and 2004, says Congress has a worse record on autocracy, including a period when former Prime Minister Indira Gandhi suspended democratic rights in the 1970s.

"They keep going on about fascism and Hitlerism, rather than addressing the issue of the day - misgovernance," BJP spokeswoman Meenakshi Lekhi said in response to the minister's comments.

In large rallies across the country, Modi has been campaigning on his record of fast economic growth as chief minister of the state of Gujarat, promising to create jobs and help India become a global power, while attacking the government for a string of corruption scandals.

He contrasts his modest background as a tea-boy and political outsider to the Nehru-Gandhi family dynasty that runs the Congress party. Last month, bombs exploded at one of his rallies, killing six people and raising worries about his safety. Investigators blame Islamic militants for the attack.

Modi has close ties to the Rashtriya Swayamsevak Sangh (RSS), a view that many consider divisive in the multi-religious nation. The group has long backed the BJP but some commentators believe it is now taking a larger role in politics.

Ramesh said the 2014 election seemed to be between Congress and the RSS, a view echoed by Finance Minister P. Chidambaram on Tuesday in an interview in which he criticised the BJP's choice of candidate for prime minister.

"We think that the RSS ideology is a dangerous ideology," Chidambaram said.

An opinion poll conducted by Cvoter and published last month predicted Congress would win its lowest ever number of parliamentary seats in the 2014 election. Since then the party has called for such polls to be banned, calling them unscientific.

If that poll proved correct, Modi could form the next government, but he would need to win over coalition partners.

However, the real Baap of the corporate brigade,the United states of America has silently endorsed the Lotus India Map of Goldman sach and the US would be willing to work with BJP's prime ministerial candidateNarendra Modi, if the party is voted to power in the next general elections, senior Obama administration officials here have said asserting that the enduring bilateral relationship is to continue irrespective of the poll results.

"We will work with the leader of the world's largest democracy. There is no question about that," a senior US official yesterday said when asked about the prospects of working with an Indian Government led by Bharatiya Janata Party's PM nominee Narendra Modi.

Dismissing visa as a non-issue, the official said it was largely a creation of the Indian media and not at all an issue in the US Government.

"Visa issue is a media creation. He has to apply and we will review. He (Modi) has not applied (for a visa)," said the official, who spoke on the condition of anonymity.

"You said you have very strong relationship with Prime Minister Singh. If Modi become the Prime Minister next year, would that be problematic for the United States?" the official was asked.

"I think that the United States had a very strong relationship with the previous Indian government when it was under BJP leadership," the US official said.

"I think the relationship between the United States and India is an enduring one, it is a bipartisan in the United States, irrespective of who is in office. And we believe that (in a ) multiparty (system) in India that it is supported by all political parties, we expect that relationship to continue," the official said.

According to another US official "there is not a lot of angst about him (Modi)" in the US Government, but it is believed that the Administration has decided to maintain the status quo on this issue for the very reason that it might be seen as an interference in the internal domestic polity of India.

Any change in the status quo, might be used as political parties to politicise the issue ahead of the elections, sources said, adding that the US would be working with any leader who is elected as the Prime Minister of India after the next years general elections.

Anand Sharma hits out at Goldman Sachs for "messing with India's politics"

By CL Manoj, ET Bureau | 8 Nov, 2013, 08.21AM IST

Sharma hit out at Goldman for "messing around with India's domestic politics" in a rare noholds-barred attack by a senior minister on a global investment bank.

NEW DELHI: Commerce and Industry Minister Anand Sharma has hit out atGoldman Sachs for "messing around with India's domestic politics" in a rare noholds-barred attack by a senior minister on a global investment bank, after it suggested that BJP-led NDA could win the next general elections.

"I think banks such as Goldman Sachs should stay focused only on doing what they claim to specialise in," Sharma told ET in an interview.

"Goldman's latest report on Indian economyand its eagerness to push the case of a particular political leader and his party exposes two things — Goldman is parading its ignorance about the basic facts of Indian economy; and it also exposes its eagerness to mess around with India's domestic politics," the minister added.

Leave it to Voters, says Sharma

It only makes Goldman's credibility and motives highly suspect," Sharma said. Earlier this week, Goldman in a report titled "Modi-fying our view", raised its rating for Indian markets to "market weight" from "underweight" , citing optimism over political change. "Equity investors tend to view BJP as business-friendly , and its prime ministerial candidate Narendra Modias an agent of change," analysts at the bank said in a note to investors.

While the note was not an endorsement of Modi or BJP, it nevertheless had the effect of sanctifying a growing narrative among stock market participants about a likely Modi and BJP victory in the 2014 elections. Such talk cannot be pleasant reading for Congress-led UPA and its ministers, who say the headwinds facing the economy were triggered by international factors and the government had done everything to mitigate them. Sharma said topics such as elections and politics were best left to voters.

"It is time banks like Goldman realise that over 800 million Indian voters alone shall decide the future of Indian politics and elections. And these Indians will not be influenced by the motivated campaign by agencies like Goldman , which have, in any case, left behind agraveyard of their failed predictions and projections," he said. "They will only expose themselves further by trying to mess around with Indian politics," Sharma added.

Stock Market: Experts Speak Out

India hasn't been managed well for decades: Rogers

India is a wonderful country but it has not been managed very well for decades, as far as the economy is concerned, India needs new politicians, says Jim Rogers.

India's IT Sector

Go for it, Infosys; fix Obama Healthcare for free

Such a gesture would allow Infosys, which is putting up a brave face after the $34 mn fine, to demonstrate to the US, the Indian capability in the field.

India's March to Mars: 300-Day Trek

Eight recent successful projects by ISRO

The ISRO has over many years been known to come up with cost-effective space missions. Its knack for frugal engineering and adaptive technology has made the ISRO stand out in the world.

Salary & Perks

Bonus to be 100% of target: Cognizant

Cognizant President, Gordon Coburn, says we are going to pay good bonuses this year. We have communicated to employees that revenue growth is healthy, our margins are good.

AI unit in talks with Tata-SIA for maintenance deal

Air India Engineering Services is talking to the Tata-Singapore Airlines joint venture airline to provide engineering and maintenance servic...

Boardroom battle at Amul gets utterly bitter

Vipul Chaudhary accused MD of 'divide & rule'; his union's mouthpiece claims federation directionless after Kurien's exit.

Reliance Telecom's domain name plea rejected

A complaint filed by Reliance Telecom against the owner of the domain name 'reliancegroup.com' has been rejected by an international arbitra...

Declare RIL a defaulter: House Panel to Oil Min

The panel headed by Aruna Kumar Vundavalli from Andhra Pradesh, also backs the state's demand for a share in gas output and royalty from off...

Jet-Etihad deal: Ministries address MHA concerns

IB and RAW told the home ministry that security clearance for a deal in the critical civil aviation sector, which involves a UAE company.

DoT plans incentives to attract Rs 8.74 lakh-cr FDI

Telecom department is slated to discuss a slew of measures to attract FDI into local manufacturing in the next meeting of TEMC later this mo...

Business of Brands & Trademarks

Cadbury loses fight for 'Eclairs' trademark over 'non-use '

After Kellogg's and Bata, it is now the turn of Cadbury to lose a trademark for non-use, 'eclairs' in this case, experts wonder why the co couldn't come up with enough evidence.

What should traders 'buy' or 'sell' in range-bound mkts

46 Minutes ago

-

The Sensex was trading under pressure in mid-morning trade on Friday, led by losses in consumer durable, oil & gas, banks and capital goods stocks.

Nifty hovers near 6,150; banks, cap goods down

1 Hour ago

-

We remain 'Overweight' on sectors which are most likely to see earnings upgrades like IT, Healthcare, Staples and Energy," said Credit Suisse in a report.

Tata Motors net seen up 49%; how to trade it ahead of results

And see how the magic potion works as feel good in a famine struck nation that we are!

India is likely to become the third largest economy by 2030 behind China and the USA, a Standard Chartered report said while projecting that the world is in the midst of an economic "super-cycle".

A super-cycle is a period of historically high global growth, lasting a generation or more, driven by opening up of new markets, increasing trade, high rates of investment, urbanisation and technological innovation.

India is likely to be the third largest economy with a GDP size of USD 15 trillion by 2030, says Standard Chartered's Super-Cycle Report. China with a GDP of USD 53.8 trillion is projected as the biggest economy, followed by the US at USD 38.5 trillion.

Though slowdown in some major emerging economies is a concern, a modest set of reforms could trigger a growth revival in several large emerging economies, including China, India, Indonesia, Nigeria and Brazil, it said.

Indian policy makers appear to be responding to the concerns, with monetary policy now firmly signalling an anti-inflation stance and measures being taken to address the funding of the large current account deficit, the report said.

"We also remain optimistic that the focus on reforms will pick up speed once the election cycle is out of the way," it added. General elections are due in May, 2014.

Stating that "the super-cycle is transforming the world economy," the report said the share of emerging market economies could rise to 63 per cent of world GDP by 2030 from 38 per cent today.

Economies with growth rates of over four per cent - primarily emerging economies - now account for 37 per cent of the world GDP, up from 20 per cent in 1980. Their share is set to reach 56 per cent by 2030, Standard Chartered said, adding that Asia (excluding Japan) is likely to account for two-fifths of global GDP by 2030.

"World trade could quadruple in value terms to USD 75 trillion by 2030. Urbanisation and the growth of the middle classes, especially in Asia, are the driving forces," it said.

"We expect global growth to pick up in 2014-17 as emerging markets implement reforms and developed markets finish restoring balance sheets. Global growth is set to average 3.5 per cent for 2000-30, well above the 3 per cent rate for 1973-2000," it said.

"Recent pessimism about emerging markets is overdone. Concerns over the middle-income trap, excessive Asian leverage, 'broken' growth models and rising US interest rates appear exaggerated," Standard Chartered Global Head of Macroeconomic Research John Calverley said.

Calverley further added that "while we have lowered our long-term forecasts for China, India and Europe, the case for an emerging markets-led super-cycle still holds. Successful reforms will be critical for these economies to realise their catch-up potential."

Standard Chartered Bank sees marginal breach in FY'14 fiscal deficit target

MUMBAI: Standard Chartered Bank today warned of a 0.2 per cent slippage in fiscal deficit at 5 per cent of India's GDP due to slower revenue growth.

"Our base case is a fiscal deficit of 5 per cent of GDP this fiscal. This is based on the assumption that slippage of 0.65 per cent of GDP revenue proceeds and higher spending of 0.2 per cent of GDP on subsidy/bank recapitalisation, which though will be partially offset by a 0.7 per cent of GDP cut in spending," StanChart economists Samiran Chakraborty, Anubhuti Sahay and Nagraj Kulkarni said in a report.

Finance Minister P Chidambaram has been saying that the 4.8 per cent fiscal deficit target is a red line and that will not be breached.

The StanChart economists said the 0.20 per cent slippage will be due to slower tax revenue collection and uncertainty about realising non-tax revenue. Though the fiscal deficit target can be met by cutting spending, the upcoming elections are a deterrent.

"Based on the trends observed so far on tax collections, we expect tax collection to fall short by 0.65 per cent of GDP this fiscal," the report added.

On expenditure triming, the UK lender said "we believe Government can reduce spending by 0.7 per cent of GDP, which could reduce FY14 expenditure growth to 17.7 per cent and imply growth of 10 per cent in H2. But such reductions will have an adverse impact on the already weak growth."

The report noted the government has crossed 76 per cent of its borrowing target in H1 itself, the widest ever recorded in over a decade.

"The Government's ability to adhere to its 4.8 per cent deficit target will depend on one-off revenue items (disvestment and spectrum auction proceeds) and its willingness to curtail spending.

"It may still be able to achieve the target, but we believe lack of political will to curb expenditure ahead of the elections will keep these concerns a risk to the Indian economy," the report said.

On the impact of the 76 per cent drawal in H1 alone and its implications for H2, the report said sharp widening of fiscal deficit was driven primarily by slower tax mop-up and negligible proceeds from budgeted lumpy revenue items.

How S&P's negative outlook is good news for India

By ECONOMICTIMES.COM | 7 Nov, 2013, 11.27PM IST

Standard & Poor's today affirmed 'BBB-' long-term and 'A-3' short-term unsolicitedsovereign credit ratings on India, keeping outlook on long-term rating negative.

The news came as a grinch on Dalal Street, with the Sensex losing more than 300 points from its intraday high.

The markets may have reacted negatively to the news, and some experts may start to raise red flags on India's long-term story, but then there's another take on it.

The S&P's negative outlook is marginally positive, as the rating agency has almost ruled out a downgrade before the national elections, which are due in 2014, said a report released byBarclays soon after S&P came out with its outlook on India.

"Even though the negative outlook is maintained, we think S&P has effectively given the next government a window to usher in economic reforms," the report said.

"We interpret S&P's comments today as effectively providing comfort on current ratings through at least mid-2014," the report said.

S&P maintaining its stance on India is also a positive as the agency gave the government the benefit of the doubt.

Getting into the small print, S&P has given a balanced view on the state of Indian economy.

Among the positives, it cites "robust participatory democracy of more than one billion people and a free press; low external debt and ample foreign exchange reserves; and an increasingly credible monetary policy with a largely freely floating exchange rate".

Among negatives, it refers to "burden from public finance, lack of progress on structural reforms, and shortfalls in basic services typical of a nation with a GDP per capita of $1,500 ... growth has slowed steadily since then to half that level".

But then keeping faith in the future of India's economy has so far not been S&P-exclusive. Experts and brokerages have long been harping on the same - if we get positive results in 2014, probably a Modi-led BJP government, it'll be good for the markets and the economy as a whole, say some experts; while others feel that any government, Congress or BJP, augur well for India given it's 'stable'.

Here are key takeaways from S&P's outlook report:

What made S&P retain its rating?

"Our rating affirmation rests on several key strengths of India. These include a robust participatory democracy of more than one billion people and a free press; low external debt and ample foreign exchange reserves; and an increasingly credible monetary policy with a largely freely floating exchange rate," Takahira Ogawa, Director-Sovereign Ratings, S&P, said.

What are the negative factors?

"These strengths are counterbalanced by significant weaknesses, which include an onerous burden from its public finance, lack of progress on structural reforms, and shortfalls in basic services typical of a nation with a GDP per capita of $1,500. Real per capita growth had averaged more than 6% annually for fiscal year 2004-2011 (ended March 31, 2011), and had eased India's fiscal constraints and poverty levels. But growth has slowed steadily since then to half that level, fraying the social contract and putting at risk the declining trend in government debt," the ratings agency said.

What does negative outlook indicate?

"The negative outlook indicates that we may lower the rating to speculative grade next year if the government that takes office after the general election does not appear capable of reversing India's low economic growth. Barring an unexpected deterioration of the fiscal or external accounts before the election, we expect to review the rating on India after the next general elections when the new government has announced its policy agenda. If we believe that the agenda can restore some of India's lost growth potential, consolidate its fiscal accounts, and permit the conduct of an effective monetary policy, we may revise the outlook to stable. If, however, we see continued policy drift, we may lower the rating within a year," S&P said.

http://economictimes.indiatimes.com/articleshow/25388053.cms

News for SEBI India Inc top dog salaries

Sebi to rewrite rules on CEO compensation, paycommittee may become compulsory

Times of India - 3 hours ago

The Securities and Exchange Board of India, or Sebi, is considering a proposal ... A recent study said the highest CEO paywas not at the most ...

Sebi likely to put a leash on India Inc top dog salaries - Indian ...

www.indianradios.com/sebi-likely-to-put-a-leash-on-india-inc-top-dog-s...

Sebi expected to put a control on India Inc tip dog salaries. Posted about 2 hours ago | 0 comment. MUMBAI: Excessive arch executive salaries might get reined ...

Sebi likely to put a leash on India Inc top dog salaries - One.in

www.one.in/.../sebi-likely-to-put-a-leash-on-india-inc-top-dog-salaries-6...

Sebi is considering a proposal to make it mandatory for companies to get remuneration packages of promoter directors approved by minority shareholders.

Sebi likely to put a leash on India Inc top dog salaries - AllVoices

www.allvoices.com/.../15909821-sebi-likely-to-put-a-leash-on-india-inc-...

4 hours ago - Excessive chief executive salaries may get reined in soon, with India'scapital market regulator planning to rewrite the rules on compensation.

Sebi likely to put a leash on India Inc top dog salaries | www.bullfax ...

www.bullfax.com/?q=node-sebi-likely-put...india-inc-top-dog-salaries

8 hours ago - The LFB submits:At a time when most markets are being starved of yield and Treasury notes returns and mortgage rates are at record lows, the ...

Sebi likely to put a leash on India Inc... - Economic-Times ...

Sebi likely to put a leash on India Inc top dog salaries: Sebi likely to put a leash onIndia Inc top dog salariesSebi is considering a proposal to make...

Results for similar searches

Sebi cautions investors, public against dealings with Sahara ...

www.financialexpress.com/news/sebi-cautions-investors.../1078330/

Feb 23, 2013 - "Anyone transacting with them (Sahara India Real Estate Corp Ltd, ...On February 13, Sebi passed two separate orders, together running into ...

More results for sebi india inc top dog salaries

India Inc: Debt dogs refuse to tail away, even now - Rediff.com ...

Jul 22, 2013 - India Inc heavily depended on external financing, including bank borrowings, ... Of the top companies in the 1990s, Wipro grew its net shareholder equity at 35 per ... Why powerful business houses want Sebi chairman to quit.

More results for sebi india inc top dog salaries

While a litre of regular/normal or unbranded petrol costs Rs 72.45 in Delhi, branded petrol is priced at Rs 81.88. Similarly, normal diesel in Delhi costs Rs 52.54 a litre while branded diesel is priced at Rs 67.93.

"To enhance the fuel efficiency of new generation vehicles, specialised products (branded petrol and diesel) were launched by oil marketing companies in line with global trends and in keeping with the technological advancement in the automobile industry," the Oil Ministry said in a statement issued on completion of one-month of fuel conservation drive.

The Finance Ministry had in 2009 Budget introduced new duties on branded fuels, which raised the differential between regular and branded fuel. "Due to this, sales of branded fuels have started sliding," it said.

Also, in September last year, the government stopped providing subsidy on branded fuel, resulting in further dip in sales.

The current unbranded or normal diesel price of Rs 52.54 a litre includes a subsidy of Rs 9.20.

Ever since their introduction in 2002, sale of premium or branded fuels have dwindled from a peak of 5.9 million kilolitres of diesel and 3.4 million kl of petrol in 2007-08 to a mere 0.45 kl of diesel and 0.09 kl of petrol in 2012-13.

Moily has "requested the Ministry of Finance to review the duties levied on branded fuels to bring down the price differential so that consumers opt for branded fuel and this will help improve the fuel efficiency (by about 2 per cent) resulting in reduction in overall demand for petroleum products," the statement said.

Currently, the government levies an excise duty of Rs 1.20 per litre on normal or unbranded petrol while the same on branded petrol is Rs 7.50. Similarly, unbranded diesel attracts an excise duty of Rs 1.46 per litre while Rs 3.75 duty is levied on branded diesel.

Moily says the reduction in excise duty by Rs 6.30 per litre on petrol and Rs 2.29 on diesel would not impact government revenues as current sale of branded fuels was "meager". But it would help in conservation as these fuels provide improved engine performance to yield 2 per cent savings in consumption.

Branded petrol and diesel is priced at a premium to regular fuel as additives put in them remove harmful deposits from engines, prevent corrosion, reduce emissions and lower maintenance costs.

VCES had been introduced with effect from May 10, 2013 as a one time amnesty scheme for paying service tax dues for the period October 1, 2007 to December 31, 2012 without interest and penalty.

"The Union Finance Minister P Chidambaram will address trade/industry/service associations and Chambers of Commerce &Industry at Chennai, Delhi and Mumbai on Voluntary Compliance Encouragement Scheme (VCES) 2013," the Finance Ministry said in a statement today.

The minister will address the representatives of various trade associations and Chambers on VCES in Chennai on November 9, in Delhi on November 11 and in Mumbai on November 14.

The services sector contributes about 65 per cent to the Gross Domestic Product ( GDP) of country but the number of service tax payers is quite less.

Recently, Chidambaram had said that out of the 17 lakh registered assesses under Service tax, only seven lakh were filing returns.

"Many have simply stopped filing returns. We cannot go after each of them. I have to motivate them to file returns and pay the tax dues. Hence, I propose to introduce a one-time scheme called 'Voluntary Compliance Encouragement Scheme'," the Finance Minister had said in his Budget speech.

Government has set indirect tax collection target of Rs 5.65 lakh crore for 2013-14, up from Rs 4.73 lakh crore in the last fiscal.

The government is likely to appoint Siddharth Tiwari as the chief economic advisor, replacing Raghuram Rajan, who became thegovernor of Reserve Bank of India in September this year. Tiwari, a senior IMF official, will have a tenure of three years, said people involved in the appointment process.Economic Times reports.

On the other hand, ET has exposed the skin of the policy making CEOs making sufficient dent into parliamentary policymaking as the best seducer.

The Finance Ministry has asked all profit-making oil PSUs to pay a minimum 30 per cent dividend in the current financial year.

Presently, all profit-making central public sector undertakings ( CPSU) are required to declare a minimum dividend on equity of 20 per cent or a minimum dividend payout of 20 per cent of post-tax profit, whichever is higher, subject to availability of disposable profits.

However, for the 14 PSUs in the oil sector, including Oil & Natural Gas Corp, Indian OilBSE 0.14 % and GAIL India, the ministry has sought a 30 per cent dividend, official sources said.

The Finance Ministry believes dividend from CPSUs is a return on investment made by the government and it should be commensurate with profits.

"A lower than reasonable level of dividend would be construed as an implicit subsidy, which the government can ill afford, given the level of its commitments, especially in the social sector, and its obligations to meet the fiscal targets," it wrote to the Oil Ministry last month.

It asked the government nominees on the boards of profit-making CPSUs under the Oil Ministry to ensure that the state-owned firms comply with the dividend guideline for 2013-14.

The Finance Ministry said in the case of PSUs with large disposable profits or healthy cash reserves, a higher or special dividend may also be considered, they said.

ONGC, GAIL IndiaBSE -1.60 % and Oil India have declared 30 per cent dividend for the past few years.

IMF man Tiwari is currently director of the strategy, policy and review department, according to the IMF website. The department is responsible for developing IMF policies and overseeing their implementation at the country level, said the website. Tiwari is also responsible for coordinating IMF's activities with bodies such as the G8 and G20.

While the appointment is for three years, there could be some uncertainty over his tenure if the Congress-led UPA loses the elections scheduled for May 2014. The chief economic advisor (CEA) heads the financeministry's economic division.

The CEA is responsible for supervising the writing of the Economic Survey, a prestigious document presented to Parliament just before the budget, which describes the government's thinking on the economy. The economic division is responsible for preparing monthly and half-yearly economic reports. The budget will be an interim one because of elections, leaving it to the next government to present a full budget.

"Tiwari's experience in finance will be of great use in India's tricky fiscal situation," said a senior official involved with the selection process. Another official, who has previously worked with Tiwari and is now in charge of policymaking in New Delhi, said, "He holds the right credentials for the important job. He has a macro mindset, has global perspective and is best placed to advise the finance ministry at times like these."

Finance Minister P Chidambaram has promised to restrict fiscal deficit to 4.8% of GDP for the year ended March 31, 2014. Earlier this week, he vowed to restrict the current account gap to $60 billion, around 3.2% of GDP.

On Thursday, rating agency S&P said it would watch the performance of the next government before deciding whether to maintain India's bare-ly-investment-grade rating. While the position is not particularly powerful compared with other arms of the finance ministry such as the revenue department, the post has acquired a high profile because of Rajan, a renowned economist.

In case of Rajan, the CEA position was widely regarded as a stepping stone to RBI governorship. Kaushik Basu, who preceded Rajan, is also a well-known economist. Basu is currently World Bank's chief economist.

Previous occupants of the position include famous policymakers such as Bimal Jalan, a former RBI governor, and Montek Singh Ahluwalia, the deputy chairman of Planning Commission. Tiwari, who has served in IMF's Asia-Pacific, Africa and European departments, is a post-graduate from the London School of Economics and a PhD from the University of Chicago.

Tiwari has been with IMF for over 24 years and was the secretary at the multilateral agency before assuming his current role. He has closely worked with former IMF managing director Dominique Strauss Kahn, who lost his job after a sex scandal.

The Roots of Corporate Globalization in IMF/World Bank "Structural Adjustment" Policies

By Soren Ambrose

The Public Eye - Summer 2004 - Vol. 18, No. 2

Introduction

This year marks the 60th anniversary of the International Monetary Fund (IMF) and the World Bank. Although they have always been located in Washington, DC, people in the United States very often do not know much about what they do. People in Africa, the Caribbean, Latin America, and Asia know a great deal about them, however. When a delegation from either institution arrives in a country in any of these regions, it's often front-page news; when economic crises hit, people protest outside the local offices of the IMF/WB. When unrest breaks out it is often referred to as an "IMF riot."

The institutions did not seem destined for such notoriety at their founding in the waning days of World War II. They were designed as multilateral institutions – owned by their member governments and operating in their collective interest. The IMF was assigned to prevent the sort of global economic crisis that engulfed the world during the Great Depression of the 1930s: it would monitor a new system for valuing national currencies, the dollar-gold standard, to maintain international economic stability; make short-term loans to countries experiencing balance-of-payments problems; and compile an annual report on each member country's economy. The International Bank for Reconstruction and Development – which came to be called the World Bank – was established to provide funds for the reconstruction of Europe and East Asia after World War II. However, the U.S. Marshall Plan eclipsed its part in that effort, and it turned to financing infrastructure projects in Latin America and newly independent countries like India and Indonesia.

The Grim Reapers

The seeds of what the IMF and World Bank have become were sown from the very beginning in an imbalance of power and lack of democratic governance, even though it was not until the 1970s that the institutions became really controversial. Their constitutions (called "Articles of Agreement") guaranteed that the wealthiest countries would always retain control of the institutions' policies: votes on the board are allotted on the basis of how much money each country donates and a government cannot decide to pay more and get more votes – the proportions were and still are carefully managed. Today, the G8 countries (the U.S., Japan, Germany, France, the U.K., Italy, Canada, and Russia) control about 50% of the total votes, and any changes to core policies require an 85% super-majority vote. The United States has always ensured that its percentage of total votes on each board remains above 15% giving it virtual veto power. By unwritten agreement, the head of the World Bank is always a U.S. citizen, chosen by the President of the U.S., and the head of the IMF is always from Western Europe. The institutions are headquartered in the capital of the country making the largest contribution (hence Washington, DC). These percentages and customs have remained in place even as the membership of the institutions has expanded through the era of decolonization and the collapse of the Soviet Union; they now have over four times as many members (184) as they did when they started out.

During the IMF's first 30 years, this lopsided arrangement was not quite so glaring as it later became. In fact, most of its loans were made to industrialized countries, many of them among the largest shareholders. At that time the IMF was akin to a credit union for governments, a convenient and cheap source of capital for bandaging minor balance-of-payments difficulties. After the suspension of the dollar-gold standard in 1973, the IMF was a Washington bureaucracy looking for a function and by the late 1970s the industrialized countries no longer found the relatively small loans it could offer useful. A constellation of events in that decade – rapid expansion of lending by both private and public creditors to countries in Latin America, the OPEC (Organization of Petroleum Exporting Countries) oil price shocks of 1973 and 1979, and the dramatic rise in interest rates initiated by the U.S. Federal Reserve at the end of the decade – combined to severely exacerbate pressures on developing countries with substantial debt burdens. Suddenly, governments in Africa, Latin America, the Caribbean, and Asia faced difficulties in servicing their debts and, eventually, in attracting new loans, while large banks were fretting that their largest debtors might default on their loans.

Although the IMF had not been involved in developing countries before, and had no particular expertise in development, it was called upon to assemble "bailout packages" for the countries in the deepest crises. With the electoral victory of Margaret Thatcher and Ronald Reagan (who led the New Right), both neoliberal right-wing ideologues, in the United Kingdom and the United States respectively, the IMF, and soon after the World Bank, were pressed into service as advocates of their "free trade" agenda. The bailouts, the first of which went to Mexico, followed by Argentina and Brazil, were accompanied by stringent conditions. The conditions, it was promised, would ensure that the recipient countries got out of their debt traps and would restore their prosperity.

The first, obvious, problem with that promise was that the funds being lent to the governments were not intended for the countries themselves, but to pay off foreign creditors. The money no sooner arrived than it was remitted back abroad; what remained was a massive new debt for the national government. Neither those countries, nor those that got later versions of the same programs, have ever emerged from their debt problems. On the contrary, the debt problems have only intensified as the cycle of borrowing new money to pay off old loans drives up debt totals. Mexico's debt, for example, had tripled from its 1982 levels when it found itself in a new crisis in 1994, requiring another IMF bailout loan of $50 billion.

Secondly, the conditions were predicated on the theories of neoliberalism, the "free market" doctrine of Thatcher and Reagan, which exalts the "invisible hand" of market capitalism – the idea that the best economic outcomes result if markets are left to determine their own course, without government intervention. Until the neoliberal revolution of 1980, the Keynesian precept that government intervention was required to direct markets toward the greater good dominated both the West and large parts of the Third World. Most economists in industrialized economies fall somewhere between John Maynard Keynes and Milton Friedman, the leading proponent of the free market approach. But Friedman and his followers who adopt an extremist line, advocating as much erosion of government influence as possible, gained particular influence with right-wing politicians in both the United Kingdom and the United States. Their approach has recently come to be called "market fundamentalism," since it sees "freer" markets as the solution for every economic problem, actively twists evidence to conform to its theories, and refuses to accept any deviation from its doctrine, even in the face of evidence that it does not deliver on its promises. Adherence to market fundamentalism is more a matter of faith than reason, and in the absence of much proof, its dogmatism has only gotten fiercer.

The emphasis in the bailout conditions was on opening up economies to foreign investment and market participation, with a corresponding deregulation of all aspects of the economy. This mandated a retreat from policies of "import substitution" then popular in Latin America, Asia, Africa, and the Caribbean – the practice of fostering industrial development by encouraging local manufacturing to produce goods that had previously been imported. Tariffs and other controls on trade that went along with import substitution were anathema to the neoliberal outlook, since it inhibited the free movement of markets and contradicted the doctrine of "comparative advantage," which holds that the invisible hand works best when everyone produces and sells those things which they can provide most efficiently.

The IMF had found its new niche, serving as a de facto "lender of last resort" – the last source of capital or credit when confidence in creditworthiness is eroded – for indebted countries in the South. It would not restrict itself to countries in acute financial crisis, like the large Latin American economies were, but would offer its assistance to any country in that region or in Africa, the Caribbean, and Asia experiencing difficulties with debt and obtaining credit on international markets. Rather than the 6-month loans it used to make for simple balance-of-payments difficulties, it made its most common instrument a loan that was disbursed in installments (called "tranches") over 3 years, and was repayable over 10 or 20 years. These loans and the policy conditions (or, in IMF parlance, "conditionalities") attached to them were called "structural adjustment programs" or SAPs. (Recognizing the negative connotation that term has since acquired, the institutions have tried to rename the programs, most egregiously with the Orwellian term "poverty reduction and growth.")

Adjusting Unconditionally

The conditions imposed on desperate governments signing up for SAPs differed little from those applied to Mexico in its 1982 bailout, though the scope was gradually widened and details refined. Indeed, the conditions imposed with middle-income country bailouts in the 1990s and the new century – in Mexico, Thailand, Indonesia, South Korea, Brazil, Russia, and Argentina – also mirrored those of SAPs, which themselves were remarkably similar to one another, whether applied in Africa, Asia, the Caribbean, or Latin America. The IMF is essentially a one-size-fits-all factory. To the extent that documents occasionally surface with the wrong country's name in sections, when a "search and replace" job at the Washington headquarters goes awry.

These conditions have to date been imposed on over 100 countries, not only by the IMF in its 3-year programs, but in numerous World Bank policy (as opposed to infrastructure) programs, which follow up on the IMF packages and now constitute up to half of the Bank's lending. Few governments are convinced of the benefits of SAPs, but once they have run out of places to get credit, they have little choice if they wish to remain part of the global economy. The IMF's coercive power comes not only from its "lender of last resort" function, but also from the fact that it has been assigned, informally, a "gatekeeper" role. If a country does not have an IMF agreement which it is successfully adhering to (in the IMF's judgment), it cannot get loans, aid, debt relief, or credit from any other multilateral institution, aid agency, government, or private financer.

Many of the structural adjustment conditions imposed by the IMF and World Bank on countries in Latin America, Africa, and Asia have been imposed domestically in the United States since the Reagan Administration. Further, market fundamentalism and neoliberal ideology are not the sole preserve of the political Right in the United States, or, for that matter, in many parts of Western Europe. The Democratic Leadership Council—that Bill Clinton led before becoming president—representing the "New Democrats" within the Democratic Party and the "New Labour" wing of the Labour Party in Britain, for example, have implemented, defended, and even extended many of the prescriptions the conservative Reagan and Thatcher Administrations first introduced in the 1980s. These have included further reducing or eliminating government regulations, including environmental protections; further shifting the tax burden from the wealthy to the middle and working classes while cutting government spending, ostensibly due to budget shortfalls; privatizing of public resources including education and other municipal services; and cracking down on organized labor.

The standard list of structural adjustment conditions imposed by the IMF and the World Bank on their borrowers includes:

1. Reduction of Government Expenditures. Across Africa, Asia, Latin America, and the Caribbean, the government has been the leading source of employment and channel for capital, since an undeveloped economy has fewer people with disposable investment income. But market fundamentalists define governments as inefficient economic actors, and so prioritize reducing their economic role. Privatization (see below) is one of the hallmarks of this approach, but so is reducing all government expenditures. A second justification for cutting government costs is to free up money that can be used for repaying external debts. These budget cuts take two related forms:

a. Cuts in Social Spending: Slashing government-supported programs for healthcare, education, housing, food security, etc. Private providers of these services usually charge fees that put them far out of reach of the impoverished majorities in these societies. Much of the burden of replacing these eliminated services falls on women, who are already over-extended. At the World Bank's suggestion, or sometimes requirement, countries have tried to defray costs for providing what services are left by adding "user fees," which have a demonstrated record of discouraging school attendance and usage of clinics. After campaigns in several African countries and the United States, the Bank reversed its stance on user fees for primary education, but not for health care.

b. Shrinking of Government: Reducing government budgets means not just cuts in programs, but massive layoffs and reduction of government capacity. Given the government's relatively larger role in Asian, African, Latin American, and Caribbean countries, mass layoffs of government employees have a dramatic impact on the middle and working classes, and often go deeper, since a person employed in the formal sector often supports many family members. Reductions in government activities also have an impact on the rest of the economy, much of which relies on doing business with government agencies. Additionally, fewer government staffers are able to monitor and regulate businesses' adherence to labor, environmental, and financial rules and regulations.

2. Increase in Interest Rates. The IMF is dedicated above all to limiting inflation. Charging higher interest rates for credit is the classic way to control inflation. As Joseph Stiglitz has pointed out, the IMF's charter calls for it to guard economic stability and work toward full employment. It has chosen to interpret stability narrowly as low inflation, and has jettisoned any concern with employment. In many cases, say Stiglitz and other mainstream economists, a moderate rate of inflation is perfectly acceptable if it means a greater rate of employment.

High interest rates have the effect of strangling an economy: small and medium-sized businesses and farmers cannot afford credit, and so are often forced out of business. Small farmers forced to sell their land end up working as sharecroppers or landless labor, or are forced onto more marginal lands, leading not only to less productive agriculture but environmental devastation. Additionally, rural people are forced to move to urban areas already swollen with other economic migrants who are also desperate to take any jobs, regardless of the pay, whether in sweatshops, the informal economy or in illicit activities.

For foreign investors, however, the policy has a real pay-off. Higher interest rates on credit usually imply higher interest paid on government bonds, which can lead to an influx of "hot money" – short-term investments by profit-seeking investors. Hot money often has a destabilizing impact since it can be withdrawn quickly, it is not suitable for productive investments, and a sudden rush for the exits can leave a government struggling to find the cash to pay off bondholders. It was precisely this scenario that threw Mexico into its 1994 "peso crisis," as U.S. investors, tempted by an increase in U.S. interest rates, wanted to cash in their dollar-denominated bonds simultaneously.

High interest rates were among the most controversial measures the IMF imposed on the East and Southeast Asian economies (South Korea, Indonesia, Thailand) during the 1997-98 regional crisis. IMF policies were widely blamed for exacerbating and prolonging the social impact of the crisis. Indeed, the IMF's insistence on fighting inflation in East and Southeast Asia when there wasn't really any inflation to fight marked a turning point at which policymakers and academics started to question the IMF's policies.

3. Privatization: It is an article of the market fundamentalist faith that the private sector does things better and more efficiently than the public sector. In most countries in the Caribbean, Asia, Africa, and Latin America, almost all of who came out of the colonial experience, many of the largest and most vital companies were partially or wholly government-owned. This was identified as a weakness by the IMF, which since the earliest bailout packages has urged countries to privatize enterprises that were publicly owned. While in some cases public sector companies were performing poorly, the blanket solution of privatization has proven to be a cure worse than the disease. Because local investors rarely have sufficient resources to both buy and then operate privatized enterprises, the privatization boom has led to the transfer of a vast amount of national resources into foreign hands. Foreign investors often transfer out locally generated income rather than spend or save it within the country. Foreign-owned corporations are also more likely to shirk pledges to maintain previous levels of services, and more likely to shut down facilities when difficulties emerge. In Argentina, for example, most of the banking sector was privatized to foreign owners during the 1990s; when the financial crisis reached its peak in 2001, many of the banks simply shut their doors and left Argentina.

;The sell-off of national assets has also spurred an outburst of corruption in many countries: rules for fair bidding processes are ignored; secret deals with investors close to the government, whether foreign or domestic, are made, and prices far below the value of the assets are charged. And for the people working in the privatized companies, the process has usually meant mass layoffs and for consumers it has often meant a reduction in services and higher costs. For instance, people in rural areas lose services such as telephones, which are deemed no longer "economical" for a private telecommunications company to provide. Private investors frequently ignore labor rights, such as the right to organize a union, with a wink from the governments.

In recent years, the emphasis on privatization has grown more intense, with the IMF cutting off funds or promised debt relief to governments that do not adhere to timetables established by the institution's programs. The World Bank has taken the lead in encouraging, and often requiring, borrowing countries to privatize the most basic, essential services, such as healthcare, education, and water provision. Activists in the affected countries, for instance Colombia, have responded with militant campaigns to retain public control of these most fundamental services, but the Bank, with U.S. urging, continues to push the privatization agenda.

4. Investment Liberalization: IMF and World Bank programs have long required countries to open up to foreign investors, which in practice means eliminating laws limiting foreign ownership of resources, businesses, or enterprises in certain sectors. Taxes on money repatriated to the company's home country are also to be dropped or significantly reduced. This, of course, is one of the bedrocks of corporate globalization: the facilitation of foreign corporations doing business anywhere in the world. As countries compete for foreign investment, they begin a "race to the bottom" similar to the spectacle of U.S. cities bidding for a baseball team: promises of deeper and longer tax holidays or exemptions, lower wages, more restrictions on labor unions, lax enforcement of environmental regulations, all of which is bad for workers and the environment, and severely limits benefits of foreign investment.

Investment liberalization has been key to shifting large parts of national economies into foreign hands. One of the most notorious examples of the use of the IMF to extract concessions came with the 1998 IMF bailout package for South Korea, where the first condition insisted upon was the revocation of a law prohibiting foreign ownership of financial institutions. The IMF insisted that the South Korean government allow 50% ownership of banks within one year, and 100% in two years. This "reform" had been the chief demand of the United States in trade talks between the two countries for ten years.

5. Trade Liberalization: Another bedrock of corporate globalization is the removal of what market fundamentalists call "trade barriers," and others call trade regulation. Tariffs – taxes on imports designed both to raise revenue and protect domestic industries from competition – are the main target of the IMF/World Bank conditions. Their elimination invites foreign competition into domestic markets, and, together with investment liberalization, leads to the destruction of local businesses and layoffs. It also has the effect of ruining markets for local farmers, as in Haiti and Jamaica (among many other countries), where the dumping of subsidized U.S. rice imports and powdered milk drove Haitian rice growers and Jamaican dairy farmers into bankruptcy.

The World Trade Organization (WTO) was founded in 1995, after most of Latin America, Asia, Africa, and the Caribbean had been thoroughly transformed by IMF-mandated investment and trade deregulation. Only then, when countries in those regions were dependent on trade with wealthy countries, were industrialized country governments and business interests willing to enter into a formal system of negotiation and conflict resolution on trade issues. It is no exaggeration to say, then, that the WTO is the child of the IMF and the World Bank.

In recent years the hypocrisy of industrialized countries with regard to agricultural trade has been in the spotlight at the WTO. The United States, Japan, and the European Union subsidize their producers and maintain tariffs on all sorts of imports, while the IMF and World Bank have made sure that developing countries have eliminated theirs. In the case of cotton, for example, the United States provides $3 billion in support to a few thousand cotton farmers, who make enormous profits, and effectively closes off opportunities to farmers in Benin, Burkina Faso, Mali, and other West African countries.

The World Bank has recently spent a great deal of energy scolding wealthy countries for this gross hypocrisy. It should be remembered, however, that the Bank was forcing trade liberalization on its client countries in Latin America, Africa, and Asia for 25 years, fully aware that the global trading system was stacked against them. As it criticizes wealthy governments, the World Bank should hold itself accountable for giving disastrous "advice" (the kind that could not be ignored) to so many vulnerable countries.

6. Elimination of Subsidies for Basic Goods: African, Latin American, Caribbean, and Asian governments are usually not able to afford the kinds of subsidies that industrialized countries routinely lavish on their farmers and corporations. But many have instituted price controls on basic goods and staples – bread, cooking oil, fertilizer, and petroleum – as a way of ensuring peoples' basic survival. This is seen as an inexcusable market distortion by market fundamentalism, and it is one of the first things IMF and World Bank conditions routinely target, and that industrialized country governments bring pressure to bear on. The sudden jump in the cost of living that accompanies the elimination of subsidies is often the first tangible pain felt by people in borrowing countries, and is the most frequent provocation for civil unrest ("IMF riots" are sometimes called "bread riots.")

7. Re-orientation to Export Economy: The whole thrust of structural adjustment conditions is to integrate countries in Asia, Latin America, Africa, and the Caribbean into the world economy – to encourage them to earn hard currency to service debts and to rely on foreign trade rather than aspirations to self-sufficiency. The doctrine of comparative advantage can only be fully realized when every country produces what it can most efficiently, and obtains other products and services through international trade. For developing countries, that has meant producing what the industrialized countries cannot profitably. What they can uniquely supply is agricultural commodities that grow best in tropical conditions (since most of these countries are in the tropics) and cheap labor from the impoverished, often displaced, and jobless population.

The World Bank and IMF, which required so many countries to open up to foreign investors and businesses, advised countries, particularly in Latin America, that they could exploit their advantage in providing cheap labor by building "free trade" or "export production" zones – fenced-off industrial parks where normal taxes, labor, and environmental laws do not apply, and where the goods produced (mostly apparel) are designated for sale only in industrialized countries. As the antisweatshop movement has demonstrated, this has led to widespread abuses of workers and labor rights, as well as wholesale violation of environmental regulations. It has also proved to be a volatile arrangement, with factories moving suddenly from one country to another in search of lower wages – a practice that has exposed the emptiness of the frequent promises of steadily increasing wages, more progress for labor organizing, and sustainable livelihoods.

In agricultural countries, acting on IMF/World Bank advice, farmers were offered incentives – credit, fertilizer, seed, etc. – to use their best land for producing cash crops instead of food. Soon many more countries were growing greater quantities of coffee and other cash crops. The prices fell when the most basic principle of market capitalism, the law of supply and demand, kicked in. From 1980 to 2000, world prices for 18 major commodities fell 25% in real terms; among the steepest were some of those most heavily relied on by the most impoverished countries: cotton (47%), coffee (64%), cocoa (71%) and sugar (77%). One of the paradigmatic instances of this phenomenon was the World Bank's encouragement to Vietnam to start coffee production. Vietnam quickly became the world's second biggest producer, after Brazil, and in the last three years coffee prices have plunged so low that farm families were starving to death in long-time coffee-producing areas in Nicaragua; coffee farmers in Kenya were not bothering to take their crop to market; and in Ethiopia, the birthplace of coffee, the famine of 2002-03 was blamed in large part on the impoverishing impact of the coffee crisis.

The environmental impact cannot be ignored either: in addition to the toxic wastelands produced by free trade zones, shifting food production to more marginal lands has contributed to soil erosion, which in turn creates greater vulnerability to floods, hurricanes, and other natural disasters. A third kind of export production, which existed prior to IMF and World Bank involvement but which has accelerated to earn hard currency, is the extractive sectors of minerals and oil. The World Bank is a major funder of oil and mining production, which have tremendous negative environmental and social consequences and have been shown to fail to deliver "poverty reduction."

The promise was that countries would be able to earn hard currency by selling their increased exports to industrialized countries, and using the proceeds to pay off debts and buy the food and manufactured goods they were no longer producing on international markets. Instead, falling prices and over-competition have meant countries in Africa, the Caribbean, Latin America, and Asia have found themselves mired deeper in debt, unable to afford much of anything, and with significantly reduced capacity to produce for their own people.

Conclusion

Is it possible that the World Bank or the IMF do not know the law of supply and demand? Is it possible they thought it would be suspended for their client countries? It seems unlikely. It is such blatant transgressions against common sense and human security that have convinced many people in the Global South and an increasing number of their allies in the Global North that the World Bank and IMF have priorities other than their oft-stated ones of eliminating poverty, maintaining economic stability, and contributing to sustainable development. It is not necessary to believe that the IMF and World Bank are out to deliberately impoverish non-Western countries in order to come to this conclusion. It is only necessary to recognize that the institutions prioritize the interests of the industrialized countries – and their corporations – that control the majority of votes on their boards: getting debts paid regularly; a guaranteed supply of low-cost products and commodities; access to more markets and less competition. After those requirements are fulfilled, the institutions can start looking toward development, stability, and poverty reduction. Of course by that time, the measures required for the higher priorities have made those loftier goals unattainable.

Critics often refer to structural adjustment policies "failing" for 25 years. Indeed, they have utterly failed to keep any of the promises made to ease debt burdens, restore economic stability and affluence, or foster equitable and sustainable development. This can hardly be surprising, given that a generation of structural adjustment policies have succeeded in destroying borrowing countries' food security, productive capacity, regulatory powers, and eliminating citizens' economic choices. But it is surely implausible to suggest that the two most powerful multilateral financial institutions, staffed by thousands of economists, and the finance ministers and central bankers of the world, who sit on the institutions' Boards of Governors, would have countenanced such abject "failure" for so long. Even the most zealous market fundamentalist, taking an objective look at the results of structural adjustment, should have no choice but to admit that ordering countries in Latin America, Africa, the Caribbean, and Asia to put their faith in markets has been a disaster for them.

All that it takes to restore logic is to realize that the stated goals should be viewed only as window-dressing. Structural adjustment policies have in fact worked spectacularly well for corporations, and for politically and financially powerful interests in the industrialized countries and elsewhere. They have been the foundation of what today is called corporate globalization, a juggernaut that is hard to stop, given that most of the world's most powerful and wealthiest forces are united in the effort to preserve and expand it. And, while the impact of similar policies within the United States has adversely affected the poor and working classes in this country, the U.S. elite is still able to evoke support for the "American Way of Life," which is sustained by structural adjustment overseas.

Fortunately, people's movements in Latin America, Asia, Africa, and the Caribbean, and increasingly in the industrialized world have been fighting structural adjustment and its outcomes for decades. The recent "collapse" of WTO talks in Cancún, Mexico, in September 2003, represents a potential turning point. Latin American, Asian, African, and Caribbean governments, for a variety of reasons including serious pressure from people's movements, united to say "no more" to significant parts of the agenda of market fundamentalism. Together with the missteps of the Bush Administration, which has more firmly than ever linked the U.S. government to the corporate "me-first" attitude in the minds of people around the world, Cancún heralds a new world of possibilities as developing countries stop submitting to the self-interested dictates of the industrialized world.

Soren Ambrose is Senior Policy Analyst at the 50 Years Is Enough: U.S. Network for Global Economic Justice. He can be reached at soren@50years.org.

http://www.publiceye.org/magazine/v18n2/ambrose_imf.html

The Origins of the IMF and World Bank

The World Bank and International Monetary Fund (IMF) were created at the end of World War II by the U.S. and British governments. During the war the business classes of Europe were either supporting the Nazis, getting their banks and factories bombed into oblivion or they fled Europe with all the money they could carry. On the other hand, socialists, communists and anarchists had high credibility because they were the leaders of the Resistance to Nazi occupation. In order to prevent leftists from coming to power in western Europe, it was crucial to U.S. and British elites to get the business classes back into power. This required international institutions that would promote capitalist policies and strengthen the power of the corporate sector.

The World Bank focused on making loans to governments in order to rebuild railroads, highways, bridges, ports and other "infrastructure", i.e., the parts of the economy that are not profitable for private companies to build so they are left to the public sector (the taxpayers). After an initial focus on western Europe the World Bank shifted its lending toward the third world.

The IMF was established to smooth world commerce by reducing foreign exchange restrictions and using its reserve of funds to lend to countries experiencing temporary balance of payments problems so they could continue trading without interruption. This pump-priming of the world market would benefit all trading nations, especially the biggest traders, the U.S. and England.

The unwritten goal of the IMF and World Bank was to integrate the elites of all countries into the capitalist world system of rewards and punishments. The billions of dollars controlled by the IMF and World Bank have helped to create greater allegiance of national elites to the elites of other countries than they have to their own national majorities. When the World Bank and IMF lend money to debtor countries the money comes with strings attached. The policy prescriptions are usually referred to as "structural adjustment" and they require that debtor governments open their economies up to penetration by foreign corporations, allowing them access to the workers and natural resources of the country at bargain basement prices.. Other policies imposed under structural adjustment include: allowing foreign corporations to repatriate profits, balancing the government budget (often by cutting social spending), selling off publicly owned assets ("privatization") and devaluing the currency.

Many grassroots groups in the Third World talk about the recolonization of their countries as they steadily lose control over their own land, factories and services.

From the introduction to the book 50 Years Is Enough, edited by Kevin Danaher.

http://www.globalexchange.org/resources/wbimf/origins

Why We Should Terminate the IMF & World Bank

por Christopher Whalen (whalenc@l-r-i.com) www.rcwhalen.com

Christopher Whalen is Chief Financial Officer of Legal Research International in Washington. This is a draft of an article that will appear in the next issue of The International Economy.